Navigating Financial Waters: The Journey of Data Analysis and Collection

Financial data isn’t just numbers on a screen; it’s a powerful compass guiding you towards financial freedom. This phase equips you with the tools to collect and analyze this invaluable information, uncovering spending patterns, pinpointing savings potential, and making informed decisions. It’s like having a financial advisor whispering hidden wisdom in your ear – only this one’s free!

Laying the Foundation: Collecting Comprehensive Financial Data

Think of your finances as a sprawling, uncharted territory. This phase is all about grabbing your explorer’s kit and collecting the data that reveals its hidden wonders and treacherous cliffs. We’re talking income streams, expense patterns, the whole financial ecosystem! Building a comprehensive picture takes effort, but its rewards are golden: informed decisions, smart budgeting, and the confidence to navigate any financial terrain.

So, grab your magnifying glass, and let’s embark on this data scavenger hunt! Here’s your checklist:

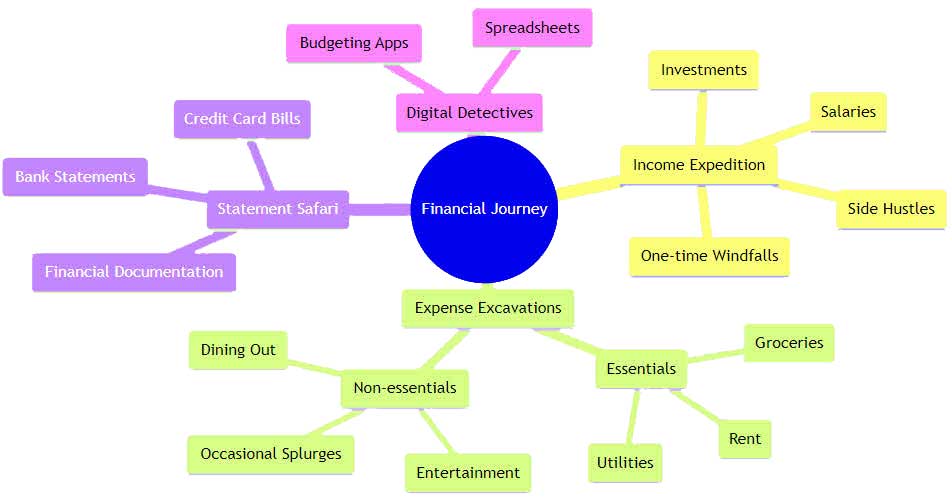

- Income Expedition: Chart your financial rivers – salaries, side hustles, investments, and any source of incoming treasure! Don’t forget those one-time windfalls.

- Expense Excavations: Unearth the details of your spending habits. Categorize them, from rent and groceries to that occasional splurge (we all deserve it!).

- Statement Safari: Track down your bank statements, credit card bills, and any other financial documentation. These are your hidden maps, revealing past routes and potential shortcuts.

- Digital Detectives: Utilize budgeting apps or simple spreadsheets to organize your data findings. Trust us, spreadsheets can be your financial treasure chest!

Remember, thoroughness is key. The more data you gather, the clearer your financial landscape becomes. You’ll spot spending leaks, identify budgeting opportunities, and build a roadmap for reaching your financial goals. So, don’t shy away from diving deep – every piece of data is a valuable clue on your journey towards financial mastery!

Insight Through Analysis: Examining Financial Statements

We’ve gathered the data bounty, now it’s time to unlock its secrets! This phase is all about analyzing your financial statements, those cryptic documents that hold the keys to understanding your financial health. Think of yourself as a financial detective, dissecting the clues hidden within these documents, ready to expose the truth about your financial situation.

Grab your magnifying glass and let’s delve into the treasure trove of insights! Here’s what we’re looking for:

- Balance Sheet Bonanza: This document is your financial snapshot, capturing what you own (assets) and what you owe (liabilities). It’s like your financial X-ray, revealing your overall net worth and financial stability.

- Income Statement Investigation: Follow the money trail! This statement tracks your earnings and expenses over a specific period, giving you a clear picture of how much you’re bringing in and where it’s going. Identify spending patterns, pinpoint potential savings, and track your progress towards your financial goals.

- Cash Flow Chronicles: This statement sheds light on the lifeblood of your finances – your cash flow. It reveals where your cash comes from and where it goes, whether you’re swimming in a surplus or struggling with a deficit. Use this insight to manage your cash flow effectively and avoid any dry spells.

Remember, analyzing these statements isn’t about deciphering ancient scrolls. It’s about gaining valuable insights to make informed decisions. These documents are your financial roadmap, revealing potential pitfalls and guiding you towards a smoother, more stable financial future. Don’t be intimidated – with a little effort and our handy checklist, you’ll be a financial statement sleuth in no time!

Evaluating Income and Expenses: A Path to Profitability

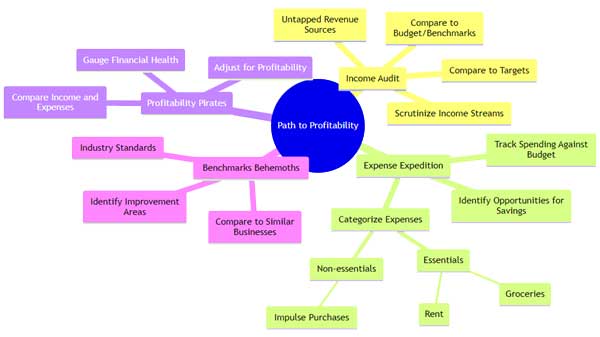

We’ve dissected the financial statements, now let’s get granular! This phase is all about diving into the heart of your finances: income and expenses. Think of it like sailing through financial currents, with one eye on your earnings and the other on your outgoings. By analyzing these two forces, we’ll navigate towards profitability and uncover hidden treasure in the form of cost-saving opportunities.

Grab your financial compass, and let’s explore! Here’s how we’ll chart our course:

- Income Audit: Scrutinize your income streams. Are you hitting your targets? Are there untapped revenue sources waiting to be discovered? Compare your actual earnings to your budget or industry benchmarks to identify gaps and potential growth avenues.

- Expense Expedition: Embark on a spending safari! Categorize your expenses, from essentials like rent and groceries to those occasional impulse purchases. Track your spending against your budget or personal benchmarks to reveal hidden leaks and opportunities for trimming the fat.

- Profitability Pirates: Ahoy, profit hunters! Compare your income and expenses to gauge your financial health. Are you sailing in the black or battling a red tide? This analysis will expose areas needing adjustments, guiding you towards profitability and financial harmony.

- Benchmarks Behemoths: Don’t sail alone! Compare your financial metrics to similar businesses or industry standards. Are you lagging behind or leading the pack? This insight can reveal areas for improvement or validate your financial course.

Remember, analyzing income and expenses isn’t just about crunching numbers; it’s about gaining control. By understanding your financial currents, you can adjust your sails, optimize your spending, and steer towards a profitable future. So, grab your financial compass, unfurl your analytical sails, and let’s conquer these financial waters together!

In Summary: The Vital Role of Data in Financial Decision-Making

Ditch the financial blindfold! Your secret weapon for conquering uncertainty? Your own data. It’s not just a mirror to your finances, it’s a roadmap to growth, revealing hidden potential and guiding you towards a brighter financial future.

Tired of just browsing? Start earning

Unlock your financial aspirations with a smart online platform that rewards you everyday. This platform offers an innovative way to bolster your savings, helping you inch closer to your financial goals and objectives, one rewarding task at a time. Email me for the link and guide: kristal@coachkristal.com

Setting Financial Goals and Objectives

Related:

All About How Childhood Shapes Our Financial Future

Top 5 Financial Discipline Tips