Ready to crack the code of your financial behavior? Buckle up, because we’re about to dive into the mind-bending world of The Psychology of Money. Think less number crunching, more understanding the “why” behind your spending, saving, and investing habits.

The Psychology of Money

Part 1

Ever wondered why that shiny gadget suddenly seems irresistible right after payday, or why the stock market makes you break out in cold sweats? It’s not just numbers and charts, folks. Our brains play a HUGE role in our financial decisions, often in sneaky, hidden ways.

Fear not, financial fumblers! In this corner of the internet, we’ll be uncovering the fascinating secrets of behavioral finance. We’ll learn how our emotions, biases, and even childhood experiences influence our money moves. We’ll explore the psychology of saving, spending, and investing, equipping you with the tools to make smarter, happier financial choices.

Think of it as a brain-training session for your wallet. We’ll debunk money myths, flip the script on your money mindset, and give you some practical tips to become the savvy spender, stress-free saver, and confident investor you were always meant to be.

So, ditch the “adulting is hard” vibes and join us on this epic quest to understand your financial self. We’ll laugh, we’ll learn, and we’ll most definitely leave you feeling more empowered about your money. Let’s get this financial psychology party started!

The Power of Long-Term Thinking in Building Wealth

This isn’t about instant gratification, it’s about planting seeds today and harvesting a bountiful financial future tomorrow. Think of it as building a money tree, one smart decision at a time.

Ditch the “get rich quick” schemes and unlock the real secret to wealth: long-term thinking. Here’s why long-term thinking is your financial BFF:

- Compounding Wealth: It’s like magic, but with math! Your investments grow not just on their own, but also on the gains they make, snowballing into a bigger and better pile over time.

- Delayed Gratification: Say goodbye to impulse buys and hello to strategic saving. The ability to resist instant gratification today means bigger rewards and more freedom down the line.

- Financial Planning: Ditch the guesswork and create a roadmap to your financial goals. Knowing where you’re headed makes every step you take count. ️

- Stability and Security: Forget the financial rollercoaster. Long-term thinking builds a strong foundation for your future, so you can weather any financial storm with confidence.

So, ditch the “YOLO” mentality and embrace the power of long-term thinking. It’s not about waiting forever, it’s about making smart choices now for a brighter, richer tomorrow. Let’s turn that money tree into a financial forest!

Long-term thinking requires patience and discipline, but the rewards are worth the wait. Think of it as investing in your future self – the one who’s thanking you for all those wise decisions you made today.

Ready to plant the seeds of your financial future? Stay tuned for some awesome tips and tricks to get you started!

The Psychology of Money

Part 2

Overcoming Greed and the Pitfalls of Excessive Risk-Taking

Let’s be honest: money makes the world go round, and sometimes, it can feel like all we go round and round about. We chase that extra dollar, that bigger house, that flashier car, driven by a seemingly insatiable hunger for more. But here’s the thing: greed, like a casino buffet, can leave you feeling bloated and broke.

That’s where risk management comes in, the financial equivalent of a designated driver ensuring you get home safe and sound, wallet intact. Because let’s face it, excessive risk-taking is basically playing financial roulette, and the odds of landing on “bankruptcy” are not in your favor.

So, how do we outwit our inner gambler and build a sustainable financial future? Buckle up, because we’re about to dish out some wisdom that’ll make your bank account smile:

Greed vs. Green: Taming Your Inner Gambler for Financial Freedom

- Ditch the “get rich quick” mentality. Remember the tortoise and the hare? Slow and steady wins the financial race, friends. Building wealth is a marathon, not a sprint.

- Befriend risk management. Think of it as your financial bodyguard, always on the lookout for danger. Before you jump into any investment or venture, assess the risks, do your research, and make informed decisions.

- Remember, happiness isn’t just a pile of Benjamins. Sure, financial security is important, but true wealth goes beyond the numbers. Invest in experiences, relationships, and things that bring you genuine joy.

- Celebrate small wins. Every step towards your financial goals, no matter how small, is a victory. Acknowledge your progress and stay motivated!

- Seek help if needed. Financial planning can be tricky, so don’t be afraid to consult a professional. A financial advisor can help you navigate the complexities of money management and keep you on track.

Taming your inner gambler is a journey, not a destination. There will be bumps along the road, but with the right mindset and tools, you can build a financial future that’s strong, secure, and full of green (the good kind, not the envy-tinged kind).

So, let’s ditch the casino chips and start investing in a brighter tomorrow, one smart decision at a time. Your future self will thank you for it!

Money: Myth Buster Alert! Finding Happiness Beyond Material Wealth

Okay, let’s get real: we all have that niggling suspicion that happiness lives in a mansion with a walk-in closet the size of Rhode Island. But here’s the truth bomb: studies show the link between money and happiness is weaker than a soggy teabag.

Sure, basic needs and all that jazz are important. But beyond that, chasing the material dragon can actually leave you feeling like a deflated balloon – all glitz and no gas.

So, where does real happiness hang out? Not in your shoe closet, that’s for sure. Here’s where to look:

- Your tribe: Spending time with loved ones, building genuine connections – that’s the real gold mine. Laughter, shared experiences, and those warm fuzzy feelings make your soul sing way more than any fancy gadget.

- Passion playground: What sets your heart on fire? Whether it’s painting, baking bread, or scaling mountains, pursuing your passions fuels your spirit and brings purpose to your days.

- Give it away: Sharing your time, talents, or resources with others isn’t just good karma, it’s a happiness booster shot. Helping others creates a sense of connection and meaning that money just can’t buy.

- Gratitude garden: Bloom where you’re planted! Taking time to appreciate the good stuff, big or small, cultivates a positive mindset and makes your happiness cup overflow.

So, ditch the “more is more” mantra and embrace the “real joy is non-material” revolution. Invest in experiences, relationships, and passions, and watch your happiness bank account skyrocket. Remember, life’s richest treasures come in all shapes and sizes, and most importantly, they’re free to enjoy! ✨

The Psychology of Money

Part 3

Don’t Let Your Brain Trick You: Decoding the Hidden Biases in Your Financial Decisions

Feeling like your brain plays a sneaky game of hide-and-seek when it comes to making smart financial decisions? You’re not alone! We’ve all been there, falling prey to those pesky cognitive biases that lurk in the shadows, whispering sweet nothings about get-rich-quick schemes and impulsive splurges.

But fear not, financial friends! In this lesson, we’ll shine a light on these hidden influencers, exposing their tricks and equipping you with the tools to outsmart them. Think of it as financial Jedi training, where we’ll wield the lightsaber of knowledge to cut through the fog of emotion and make rational, objective choices that benefit your wallet in the long run.

So, buckle up and get ready to meet your inner financial gremlins: Understanding Behavioral Biases that Impact Financial Decision-Making

- The Overconfidence Trap: Remember that time you thought you could time the market and ended up with a pile of virtual ashes? Yep, overconfidence bias can make us overestimate our skills and knowledge, leading to risky decisions.

- The Anchoring Anchor: Ever been swayed by the first price you see, anchoring your entire purchasing decision on it? This bias can make us overlook better deals and lead to suboptimal choices.

- The Herding Herd: Feeling the pressure to “follow the crowd” when it comes to investments? Herd mentality bias can make us blindly copy others’ decisions, even if they’re not right for us.

- The Loss Aversion Monster: The sting of losing feels way worse than the joy of winning, thanks to this pesky bias. It can make us hold onto losing investments for too long, hoping for a miracle comeback.

But don’t fret, my financially fabulous friends! By recognizing these biases and understanding their impact, we can take control of our decisions and make choices that align with our long-term financial goals. Stay tuned for actionable tips and tricks to outsmart these biases and become the master of your financial destiny!

Knowledge is power, and when it comes to your finances, knowing your enemy (in this case, your inner financial gremlins) is half the battle. So let’s keep exploring, keep learning, and keep building that brighter financial future, one wise decision at a time!

Key Takeaways: Applying Psychological Insights to Achieve Financial Well-being and Emotional Satisfaction

Money + Mojo: Mastering the Psychology of Financial Well-being

Okay, money gurus, let’s get real: financial freedom alone isn’t the key to eternal happiness. We all know that dude who has Scrooge McDuck levels of wealth but looks about as joyful as a deflated birthday balloon.

Here’s the good news: psychology can be your secret weapon for building a life that’s financially secure and emotionally satisfying. Let’s crack the code with these key takeaways:

- Ditch the “more is more” mantra: Chasing endless wealth is like running on a hamster wheel – tiring and pointless. Instead, develop a sustainable wealth creation mindset focused on what truly matters to you. Is it early retirement by the beach? Epic travel adventures? A cozy cabin in the woods? Define your “why” and let it guide your financial decisions.

- Balance your budget, balance your life: Financial goals are awesome, but don’t forget to factor in your overall well-being. Understand the psychology behind your spending habits. Are you a retail therapist? A social butterfly who loves lavish outings? Once you know your triggers, you can make informed choices that don’t leave you feeling stressed or guilty.

- Befriend your green friend: Stop seeing money as the enemy! Cultivate a positive relationship with money, viewing it as a tool to empower your dreams and create a life you love. Track your progress, celebrate milestones, and remember – you’re the boss of your financial future, not the other way around.

By integrating these psychological insights, you’ll build a financial path that leads not just to riches, but also to a happier, more fulfilling life. Remember, money is a tool, not a trophy. Use it wisely, with a sprinkle of self-awareness and a dash of joy, and watch your financial mojo blossom!

So, fellow money mavericks, let’s rewrite the script. Let’s build a financial future that’s as vibrant and enriching as our dreams. It’s all about finding the sweet spot where prosperity meets purpose, and trust me, the view from there is nothing short of amazing.

The Psychology of Money

Part 4

Conclusion: Embracing the Psychological Factors for a Holistic Approach to Money Management

we’ve reached the epic conclusion! We’ve journeyed through the fascinating intersection of psychology and finances, uncovering the hidden forces that influence our decisions and charting a course towards financial well-being with a side of emotional satisfaction. So, what’s the key takeaway? Buckle up, it’s a doozy:

Ditch the one-dimensional approach and embrace the holistic harmony!

Building wealth isn’t just about amassing mountains of cash (although, hey, if that’s your jam, more power to you!). It’s about forging a sustainable path that prioritizes both your financial goals and your overall well-being. Remember, money is a tool, not a tyrant.

Here’s how we can achieve this financial nirvana:

- Mindset Matters: Cultivate a sustainable wealth creation mindset, one that aligns with your values and long-term vision. Forget the “get rich quick” schemes and focus on building something lasting, something that brings you joy and purpose.

- Balance is Key: Don’t let your spreadsheets rule your life! Strike a healthy balance between chasing financial goals and nurturing your personal well-being. Remember, happiness isn’t measured solely in net worth. Take time for yourself, invest in your passions, and build strong relationships – they’re priceless treasures no bank account can hold.

- Be Friends with Your Finances: Understanding your emotional connection to money is crucial. Are you a spendthrift seeking dopamine hits? A saver so tight your coins squeak? Acknowledge your biases and triggers, and use that knowledge to make informed decisions that don’t leave you feeling guilty or stressed.

By adopting this holistic approach, you’ll create a financial symphony where money plays a harmonious role alongside your mental and emotional health. Remember, it’s a journey, not a destination. So, celebrate your progress, tweak your approach as needed, and keep dancing to the rhythm of your financial harmony. You’ve got this, money maestros!

And hey, if you ever need a financial friend to cheer you on or share some wisdom, this blog is always open. Together, let’s rewrite the financial narrative and turn money into a tool for joy, fulfillment, and a life that rocks on every level!

All About How Childhood Shapes Our Financial Future

Setting Financial Goals and Objectives

Gathering and Analyzing Financial Data

Related:

Is Lack Of Money Really The Root Of All Evil?

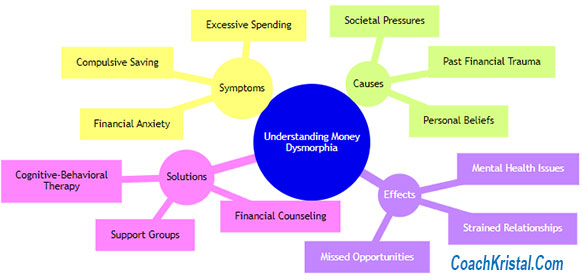

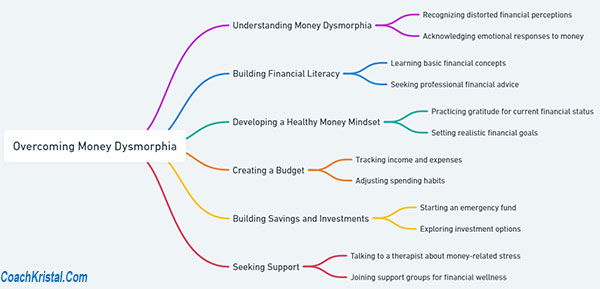

Anxiety Over Money Money Dysmorphia Guide

Earn a living while traveling or living remotely

Digital Nomads

Cultivating Prosperity and A Growth Mindset:

Female Entrepreneur Wealth Building Tips

How To Make Money Without a Job