The Rule of 72 and How it Helps You Invest Wisely

Ever wondered how long it takes for your money to magically double in size? No crystal ball? No worries!

Introducing the Rule of 72, your secret decoder ring to unlocking investment wisdom.

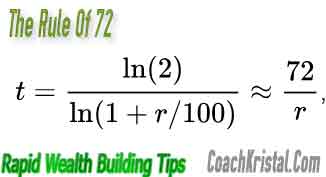

The Rule of 72 is a mathmatical formula used to figure out how long it will take to double a deposit at a given annual interest rate.

To use the Rule of 72 formula, divide the interest rate by 72, then you will know the time period it will take to double your money. For example, if you invest $100 at an annual interest rate of 12% per year, it would take about seven years for your money to double.

A Story About A Postman Named Mr Stamper – Who Discovering The Rule of 72 and Changed His Destiny Forever

Rain slicked the cobblestones as Mr. Barnaby Stamper, postman extraordinaire, trudged his usual route. Steam hissed from his worn satchel, mingling with the city’s acrid breath. For 32 years, Barney had faithfully delivered letters, bills, and the occasional birthday card, each paper scrap a mundane echo of other, brighter lives. His own life, a well-worn envelope itself, seemed perpetually stamped with the word “ordinary.”

One blustery Tuesday, a peculiar missive landed in his bag. Handwritten on faded parchment, it spoke of a forgotten formula, the Rule of 72, whispered promises of doubling wealth with time. Barney, a numbers geek at heart, squinted at the equation, a spark igniting in his tired eyes. Could this be his escape hatch from the beige wallpaper of his existence?

He hunched over his battered desk, a tattered textbook propped open like a portal to a new world. Numbers danced before him, not the monotonous figures of bills, but possibilities pirouetting in a waltz of compound interest. With trembling fingers, he plugged in his meager savings, his breath catching as the years tumbled by on the calculator screen. He could double his money! Then double it again!

Barney, the postman, was gone. In his place stood Benjamin Stamper, investor extraordinaire. He devoured books on finance, scribbled on scraps of paper, his mind abuzz with calculations. He clipped coupons with the fervor of a dragon guarding treasure, meticulously tracking every penny. His lunch became a sandwich on the park bench, the symphony of the city his entertainment. Every saved pound was a brick in the castle of his future.

Years, seasons, weather – Barney, no, Benjamin, weathered them all. The Rule of 72 became his compass, guiding him through the winding financial landscape. He invested in blue-chip stocks, dabbled in real estate, his savings, once a stagnant puddle, now a gushing river, fed by discipline and time.

One sunny afternoon, Benjamin, clad in a tailored suit far removed from his postman’s uniform, strolled past his old flat. A FOR SALE sign gleamed in the window, a mirror reflecting his own transformation. He wasn’t just wealthy; he was free. Free from the drudgery, free from the fear of a future painted only in shades of gray.

Stepping back, he smiled. The Rule of 72 hadn’t just doubled his money; it had doubled his life. In that moment, amidst the city’s clamor, the once ordinary postman stood tall, a testament to the extraordinary power of a simple formula and a man’s unwavering discipline. The stamp on his future, finally, read: extraordinary.

What You Need to Know about the Rule of 72

It’s important to remember that the rule of 72 formula only applies when the interest can be added to the initial deposit. (Compounded) Some savings accounts only offer simple interest. “Simple interest accounts” means you don’t get to earn interest from the interest.

Money can grow or shrink much faster than most people think it can. With the Rule of 72 and your current rate of inflation, you can also calculate the rate at which your money will depreciate—example 72/10 (current rate of inflation USA) 7.2 years. At 10% inflation, it will take your money 7.2 years to lose half its value. In other words, $100 will have $50 worth of purchasing power.

How to Calculate the Rule of 72 and Use It to Your Advantage in Investment Strategies

The Rule of 72 is a rule that helps us estimate how long it will take for an investment to double in value. It is a simple mathematical formula.

The Rule of 72 is based on the formula:

72/r=n, where r is the rate of return and n is the number of years.

Rule of 72 examples

For example, if you have a 7% return on your investment and you are curious to know how long it will take for the deposit to double, then you would divide 72 by 7, which equals ten years. If you invest $100 and want to double it in three years, divide 72 by 3, which tells you that you need to earn 24% per year. If you invest $10,000 and want to double it in 4 years, 72 by 4, that tells you you need to earn 18% per year.

A shortcut for estimating The rule of 72

A time-value-of-money calculator is a financial calculator used to calculate the time value of money, which can be described as the present value of future cash flows. It can also be used to calculate interest rates and loan payments.

Example of How Using the Rule of 72 can Help Make Better Financial Decisions

The Rule of 72 is a simple and easy calculation to estimate how long it will take for an investment to double, given the interest rate. For example, if you invest $1000 at 5% interest per year, your money would double in 12 years (72/5). The Rule of 72 helps when deciding whether or not to invest a certain amount of money now or wait until later.

Conclusion: Why You Should Consider Calculating With The Rule Of 72 Now More Than Ever

The earlier you put your money to work, the better. It will increase the time your money will have to grow. In theory, now is the best time to invest. It would be best if you started now.

Investing is not a one-time event. It’s an ongoing process that requires dedication and discipline. If you need discipline, hire someone who does or join an investment club with people who share your goals and values.

If you want to know how long it will take for you to double your money, take 72 and divide it into the interest rate.

If you invest money and earn at least 5% a year, it will double in about 12 years.

If you put your money in the bank, it “could” double in about 72 years.

If you put it in the stock market, it “could” double in about 72 months.

Comparing Investments With The Rule Of 72

A traditional fixed-interest rate is no longer reliable, with interest rates remaining low and volatile.

Investors are always looking for higher interest rates to maximize their profits. There are many mediocre options out there that might yield a better return.

With mainly low-interest rates and high risks, it’s hard for people to make their money grow fast.

The high-risk investment atmosphere has made many people put their money under the mattress rather than invest it in the stock market.

Investing your money into high-risk investments can be lucrative, but only if you know the risks and gains and how to safeguard your investment.

Everybody wants high-interest rates and low risks. The opportunities that allow them to have a more stable future.

“So, What Are The Numbers You Crunch With The Rule Of 72?”

*Note. My risk tolerance and willingness to explore new technologies may differ from yours.

Many factors contribute to a person’s risk tolerance. For example, the person’s age, experience, and financial status all influence how much they are willing to risk on a given investment.

Some people may be more risk tolerant than others because of their age or experience with investments. Being nearly 50 years of age… I only don’t have time to pursue traditional investments that can keep even keep up with inflation.

Next Level

Disclaimer: I am not a legal financial advisor or tax accountant. This article is for general informational purposes and does not constitute investment, tax, legal or other advice. Please consult with the appropriate professional in your country/location before making any financial decisions.