Trending Money Disorders in 2023 and 2024: Are We Headed for a Mental Health Money Meltdown?

Recently, I’ve been delving into an intriguing yet concerning trend: the rise of money disorders in 2023 and 2024. From the collapse of banks like Silicon Valley Bank in 2023 to the ongoing economic slowdown, these events are not just financial headlines; they’re shaping our mental health in profound ways.

Financial Disorders

A survey revealed that 68% of Americans had financial regrets in 2023, which caused them stress.

In 2023, the primary financial regret for the largest group of respondents (20%) was not setting aside enough funds for retirement. This sentiment was particularly strong among Baby Boomers, where 43% echoed this regret.

Additionally, about 68% of those surveyed acknowledged that their financial regrets contributed to their stress levels in 2023. Of these, 23% experienced significantly more stress, while 45% faced somewhat more stress.

When asked about the economic factors that most adversely impacted their finances in 2023, respondents most frequently pointed to high interest rates (28%) and inflation (26%).

Despite the financial hurdles and regrets faced by many in 2023, there’s a sense of optimism for the future, with 48% of survey participants feeling hopeful that their financial situation will improve in 2024 compared to 2023.

In 2024, there’s a focus on workplace health and mental support due to many employees overworking.

- Increased Attention on Employee Well-being: There’s a growing recognition of the need to address employee health, both mental and physical, as a critical aspect of workplace culture. This comes in response to high levels of burnout and stress experienced by employees.

- Managerial Role in Promoting Health: The role of managers is evolving to include more responsibility for the well-being of their teams. This shift is seen as essential to combat the negative effects of overworking and to foster a healthier work environment.

- Integration of Health Initiatives in Workplace Practices: Companies are increasingly integrating health and well-being initiatives into their standard operating procedures. This includes offering resources and support systems to help employees manage stress and avoid burnout.

- Recognition of Overworking as a Systemic Issue: There’s an acknowledgment that overworking is not just an individual issue but a systemic one, requiring organizational changes. This perspective is leading to the implementation of strategies aimed at creating a more balanced and healthy work-life dynamic.

Money Disorders Causes

Inflation is the main reason that survey participants said they were unable to stick to their 2023 financial resolutions, with 40% saying they had less money to work with because of higher day-to-day expenses.

Money Anxiety

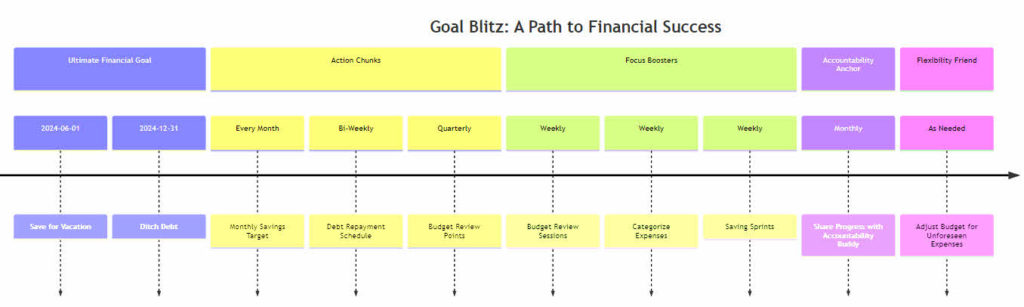

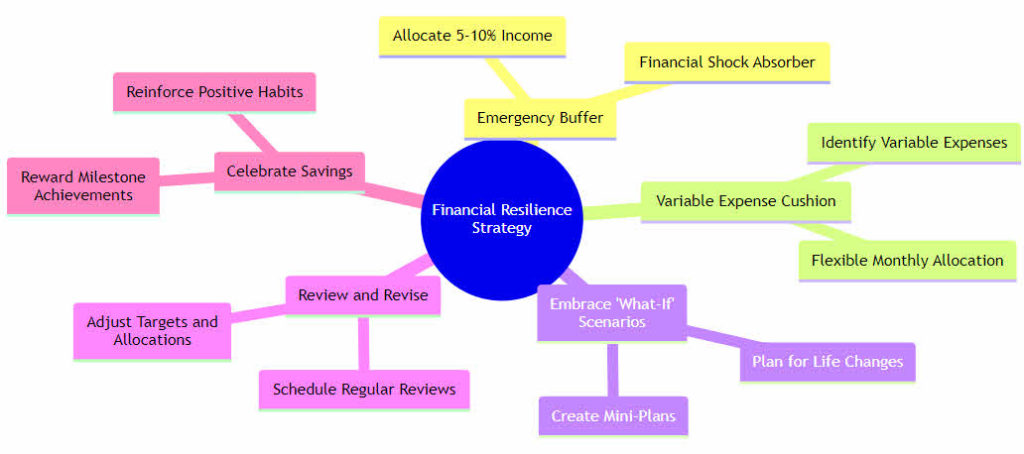

In 2024, strategies to manage money anxiety include setting realistic goals, educating oneself, budgeting mindfully, focusing on what one can control, and seeking professional help.

Money Disorders Treatment

The Substance Abuse and Mental Health Services Administration (SAMHSA) seeks $10.8 billion in Fiscal Year 2024 to bolster mental health and substance use services across the nation.

Banking Sector Instability: A Trigger for Anxiety

Imagine waking up to news of your bank failing. That’s what happened in 2023, and it’s a stark reminder of financial system fragility. This not only fuels anxiety but can lead to extreme behaviors like money hoarding.

Economic Slowdown: More Than Just Numbers

As 2024 unfolds, the economic contraction is more than statistics—it’s about real people facing job losses and dwindling incomes. This stress can exacerbate compulsive buying or gambling as coping mechanisms.

Financial Regrets and Shifting Priorities: A Rocky Road to Stability

With 67% of Americans expressing financial regrets in 2023, there’s a clear shift towards long-term savings. However, this journey is fraught with challenges like financial denial, which can impede progress.

Exploring Specific Money Disorders

- Money Anxiety: Constant worry about finances that impacts daily life and relationships.

- Compulsive Buying Disorder: An emotional coping strategy that can lead to debt and distress.

- Hoarding Disorder: Triggered by economic instability, leading to clutter and safety concerns.

- Gambling Addiction: The allure of quick fixes that can spiral out of control.

- Workaholism: Escaping financial worries through overworking, leading to burnout.

- Financial Infidelity and Dependency: Straining relationships with hidden debts or controlling finances.

- Money Avoidance and Denial: Ignoring financial problems, delaying solutions.

Seeking Help: A Path to Recovery

Always remember that help is available. Professional therapists specializing in money disorders and financial advisors can offer the guidance needed to navigate these challenges.

Conclusion: Finding Hope in Turbulent Times

Despite the bleak financial landscape, proactive steps like educating ourselves about money disorders and prioritizing mental health can lead to a healthier relationship with money.

More Bang For Your Buck

- Do you believe inflation is real?

- Do you believe the cost of groceries will increase?

- Would you be willing to upload your receipts

( eg: grocery receipts) for an extra 1000 dollars per year?

You can earn more if you are a big spender, investor, or want

to complete tasks for their partners.

You can also get paid for things like putting a banner on your car.

– The platform is free to join.

– Paid out over 600 million since 2008

– Get cash back from anything from Trips to Vegetables.

– Side gigs and remote work/jobs available!

Visit this page and click the blue contact me button for more info. (An email will be sent)

I hope you found this information helpful!

Related:

Money Disorders

Understanding Compulsive Buying Disorders

Understanding Compulsive Buying Disorders

Is Lack Of Money The Root Of All Evil

Narcissistic Personality Disorder

Best Way to Put Your Money to Work for You

How To Make Money Without A Job

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always consult a qualified professional for personalized guidance.