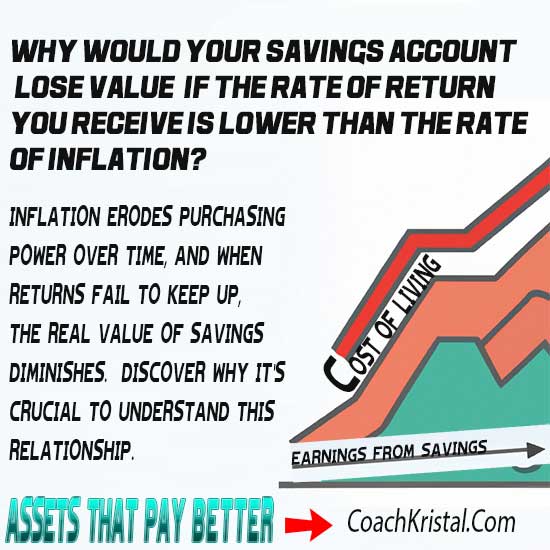

A savings account is a popular choice for individuals looking to secure their financial future and protect their hard-earned money. However, it is important to understand the impact of inflation and how it can affect the value of your savings account. This article will explore why your savings account can “lose value” if the rate of return you receive is lower than the rate of inflation.

- Understanding Inflation and Its Effects on Savings Accounts

- The Role of Monetary Policy and Interest Rates

- Impact of Inflation and Lower Returns on Savings Accounts

- Investment Options and Treasury Bonds

- Considering Investment Returns and Treasury Yields

- Related FAQs

- Assets With Greater Rewards

Understanding Inflation and Its Effects on Savings Accounts

Inflation refers to the gradual increase in the cost of living and the erosion of the purchasing power of money over time. When inflation is high, the value of money decreases, and it takes more money to buy the same goods and services. This has a direct impact on savings accounts, as the returns earned may not be enough to keep up with the rising prices of goods and services.

The Role of Monetary Policy and Interest Rates

Monetary policy, implemented by central banks, plays a crucial role in managing inflation and promoting economic stability. One of the key tools used in monetary policy is the adjustment of interest rates, particularly the federal funds rate. When interest rates increase, borrowing becomes more expensive, which can help curb inflation by reducing spending. However, higher interest rates also impact savings accounts, as banks may offer higher rates of return to attract deposits, thus potentially offsetting the effects of inflation.

Conversely, when interest rates are low, borrowing becomes more affordable, stimulating economic growth. While this may benefit borrowers, it can pose challenges for savers. Lower interest rates on savings accounts mean that the rate of return may be insufficient to outpace inflation, leading to a decrease in the real value of savings over time.

Impact of Inflation and Lower Returns on Savings Accounts

When the rate of return on a savings account is lower than the rate of inflation, the purchasing power of the funds decreases. Even if the nominal balance of the savings account increases, the ability to buy goods and services diminishes. Over time, this can have significant consequences for individuals trying to meet their long-term financial goals.

Investment Options and Treasury Bonds

To combat the effects of inflation, individuals may consider exploring alternative investment options. Treasury bonds, issued by the government, are considered relatively low-risk investments. These bonds offer fixed interest payments, which can help preserve the value of savings by keeping pace with inflation. The bond yield, influenced by factors such as demand, economic conditions, and monetary policy, determines the returns on treasury bonds.

Considering Investment Returns and Treasury Yields

In addition to savings accounts and treasury bonds, individuals may diversify their investment portfolio to potentially increase their returns. Exploring options such as stocks, mutual funds, or real estate can provide opportunities for higher yields. However, it is crucial to carefully assess risks and seek professional advice when venturing into these investments, as they carry higher levels of risk compared to savings accounts or treasury bonds.

Related FAQs

- How can I protect my savings from the effects of inflation?

- One way to protect your savings from the effects of inflation is by investing in assets that have historically outpaced inflation, such as stocks or real estate. These investments have the potential to provide higher returns that can offset the impact of inflation on your savings. Additionally, consider diversifying your investments to spread the risk and explore inflation-protected investment options like Treasury Inflation-Protected Securities (TIPS) or inflation-indexed bonds.

- What are the risks associated with higher-yield investment options?

- Higher-yield investment options, such as stocks or mutual funds, come with inherent risks. The value of these investments can fluctuate due to market volatility, and there is a possibility of losing money. It is important to carefully assess your risk tolerance, do thorough research, and seek professional advice before investing in these options. Consider your financial goals, time horizon, and diversify your investments to manage risk effectively.

- How does the cost of living impact the value of savings accounts?

- The cost of living refers to the price of goods and services necessary for daily living. As the cost of living increases over time due to inflation, the value of savings accounts can diminish if the rate of return on the account fails to keep pace with the rising prices. It is crucial to monitor inflation rates and ensure that the returns on your savings account are competitive enough to maintain the purchasing power of your savings.

- Can I change my savings account if the rate of return is lower than inflation?

- Yes, if you find that the rate of return on your current savings account is consistently lower than the rate of inflation, you may consider switching to a different savings account or exploring alternative investment options. Look for accounts that offer higher interest rates or consider investing in assets that have the potential to outpace inflation. However, carefully review the terms and fees associated with any new account or investment before making a decision.

- Should I consult a financial advisor for managing my savings and investments?

- Consulting a financial advisor can provide valuable guidance and help you make informed decisions regarding your savings and investments. A financial advisor can assess your financial situation, goals, and risk tolerance to develop a personalized plan that takes into account inflation, interest rates, and investment opportunities. They can also provide ongoing advice and monitor your portfolio to ensure it aligns with your long-term objectives.

Remember, protecting the value of your savings requires staying informed, being proactive, and regularly reviewing your financial strategy. By understanding the relationship between inflation, interest rates, and savings account returns, you can make informed decisions to safeguard the purchasing power of your savings and achieve your financial goals.

Assets With Greater Rewards

💰 Looking for assets that pay better? 💼 Explore opportunities beyond traditional savings accounts. 📈 Consider much higher potential rewards. 💸 Diversify your portfolio and stay informed to make the most of your financial journey. The Global Greater Rewards Project