Understanding Money Dysmorphia: A Comprehensive Guide

Welcome to your go-to guide for understanding and navigating the complexities of money dysmorphia. For over a decade, I’ve explored the psychological aspects of money management, and I’m here to share insights into this often misunderstood topic. Let’s dive into a clear, actionable plan to understand and address money dysmorphia in six straightforward steps.

Understanding Money Dysmorphia in 2023: A Beginner’s Guide in 6 Steps

- Identify the Signs of Money Dysmorphia

- Understand the Psychological Roots

- Develop Healthy Money Habits

- Seek Professional Advice

- Join Supportive Communities

- Cultivate a Positive Money Mindset

Follow These Steps to Grasp Money Dysmorphia and Transform Your Financial Well-being

Understanding Money Dysmorphia in 6 Steps: A Guide for Beginners

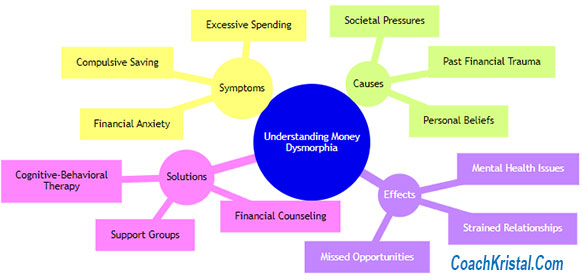

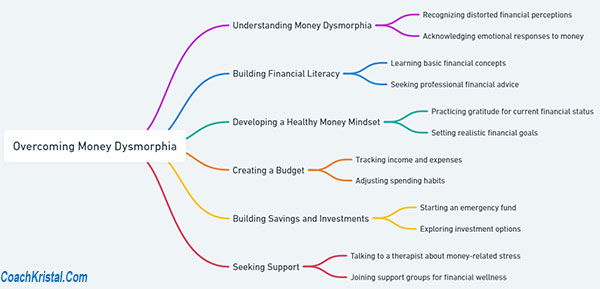

- Identify the Signs of Money Dysmorphia Recognizing the symptoms is your first step. Money dysmorphia can manifest in various ways, such as obsessive saving, excessive spending, or a constant feeling of financial inadequacy, regardless of your actual financial status.

- Understand the Psychological Roots It’s crucial to understand the psychological underpinnings of money dysmorphia. Often, it stems from past experiences, societal pressures, or deep-seated beliefs about self-worth and money.

- Develop Healthy Money Habits Adopting balanced money habits is key. This includes creating a realistic budget, understanding your income and expenses, and setting attainable financial goals.

- Seek Professional Advice Don’t hesitate to seek help from financial advisors or therapists specializing in financial psychology. They can provide personalized strategies and support.

- Join Supportive Communities Engaging with communities, either online or in-person, who understand and share your experiences with money dysmorphia can be incredibly beneficial.

- Cultivate a Positive Money Mindset Finally, work on developing a positive relationship with money. This involves changing your narrative around finances and recognizing your self-worth is not defined by monetary value.

FAQ on Money Dysmorphia

- How to Overcome Money Dysmorphia and Enjoy Your Financial Success? Learn to recognize the symptoms of money dysmorphia and adopt healthier financial habits. Seek professional advice and engage in cognitive-behavioral therapy to reshape your financial perspective and enjoy your success.

- What is Money Dysmorphia and How Can It Make You Feel Poor Even When You’re Not? Money dysmorphia is a psychological disorder where individuals feel financially insecure regardless of their actual wealth. It distorts one’s perception of financial stability and success.

- What Are the Hidden Costs of Money Dysmorphia on Health, Relationships, and Happiness? Money dysmorphia can lead to stress, anxiety, strained relationships, and reduced overall happiness. It affects mental health and can create barriers to enjoying life and making meaningful connections.

- Why Can’t I Let Myself Have Nice Things and How Can I Change That Due to Money Dysmorphia? This mindset often stems from deep-seated beliefs about money. Overcoming it involves challenging these beliefs, understanding your worth, and gradually allowing yourself to enjoy the fruits of your labor.

- How to Identify and Challenge Money Scripts That Cause Money Dysmorphia? Reflect on your thoughts and beliefs about money. Identify patterns that lead to dysmorphic views and challenge them with realistic and positive financial scripts.

- How Does Money Dysmorphia Impact Spending, Saving, and Investing Habits? It can lead to extreme behaviors like overspending, excessive saving, or poor investing decisions. Recognizing these patterns is the first step towards developing balanced financial habits.

- Is Money Dysmorphia Common Among High Earners and Why is it Misunderstood? Yes, it’s surprisingly common among high earners but often misunderstood as mere frugality or financial prudence, masking deeper psychological issues.

- How to Cope with Money Dysmorphia in a Consumerist Society? Focus on personal values rather than societal expectations, practice mindful spending, and seek support from financial therapists or support groups.

- Can Money Dysmorphia Lead to Financial Anxiety, Debt, and Hoarding? Absolutely. It can cause irrational fears leading to financial anxiety, unhealthy accumulation of debt, or hoarding money without enjoying its benefits.

- How to Break Free from the Fear of Losing Money and Live More Abundantly with Money Dysmorphia? Address the root causes of your fears, practice gratitude, set realistic financial goals, and work towards a balanced approach to money management.

Ready to Transform Your Relationship with Money?

This guide is just the beginning. Understanding money dysmorphia is a journey, and I’m here to support you every step of the way. Remember, seeking help and making gradual changes can lead to a healthier financial life and mindset.

Want My Free Guidance? “Transform Your Financial Mindset in 7 Days”

Imagine this: You’re standing at the edge of a vast, beautiful ocean. Up until now, your experience with water has been limited to shallow pools and turbulent, choppy waves that left you feeling unsteady and unsure. This vast ocean represents your financial potential and the life you can lead once you overcome the mindset that holds you back.

Overcoming Money Dysmorphia: A Life Transformed

Once you begin to transform your financial mindset, it’s like learning to swim in deeper, calmer waters. Initially, it might feel overwhelming, but soon, you realize that you have the strength and skills to navigate these waters. The fear of drowning in financial uncertainty begins to fade, replaced by a sense of control and freedom.

You start to swim with purpose, each stroke taking you further from the shore of financial anxiety and closer to the horizon of financial freedom. The water no longer feels like something that engulfs you, but rather, a medium that supports and propels you forward.

A Future Unlocked by Financial Empowerment

In this new world, your decisions are no longer driven by fear or a distorted view of your financial reality. You can plan for the future without the constant worry of not having enough, or the guilt of having too much. You find joy in the balance – saving for a rainy day while also enjoying the fruits of your hard work.

Imagine being able to make choices based on what brings you fulfillment, rather than what your money dysmorphia dictates. This could mean pursuing a passion project, investing in experiences that enrich your life, or simply having the peace of mind that comes with financial stability.

Your Journey to Financial Freedom Begins Here

Are you ready to embark on this journey? To dive into these new waters and discover what lies beyond your current financial perspective? If so, I’m here to guide you.

Want My Free Guidance? “Transform Your Financial Mindset in 7 Days”

Review my Digital Nomads page and then send me your name and email address for instant access to new ways to level up your money management game.

This is your first step towards a life where financial peace and empowerment are the norm, not the exception.

Early in our careers, we hustle hard, but

as wisdom grows, we learn the art of

letting our money hustle for us.

Are you open to new sources of income?

Check out: “Do you want another job or extra income?” Click the blue contact me button to get more info. Cashback and extra income opportunity

Remember, the ocean of financial well-being is vast and full of opportunities. It’s time to swim in the deeper waters of understanding and empowerment. Let’s start this journey together!

Related:

Money Dysmorphia Test

Money Disorders

Understanding Compulsive Buying Disorders

Understanding Hoarding Disorders and Money