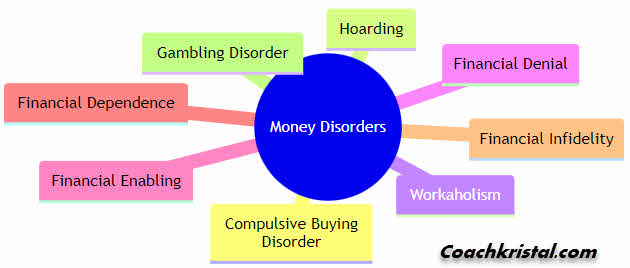

Does Money Rule Your Life? Exploring the Hidden World of Money Disorders

Money plays a complex role in our lives, but what happens when our relationship with it becomes unhealthy? We all experience financial stress or make occasional splurges, but when these behaviors become persistent patterns causing significant distress, they might signal a deeper issue: a money disorder.

These disorders, often rooted in underlying psychological struggles, manifest in diverse ways. Imagine someone compulsively stockpiling cash out of fear, another constantly chasing that winning bet, or perhaps someone working tirelessly just to avoid facing their finances. These are just a few examples of the various subcategories of money disorders we’ll explore in this blog series.

In simple terms, we’ll delve into the complexities of these often unspoken conditions, examining their signs, their potential causes, and most importantly, offering hope and guidance. So, join us as we navigate the fascinating and sometimes challenging world of money disorders, and equip ourselves with the knowledge to build a healthier relationship with money.

- Compulsive Buying Disorder: This is when someone frequently gets an uncontrollable urge to shop, leading to excessive spending.

- Hoarding: People with this disorder tend to save items excessively, including money, often due to a fear of scarcity or loss.

- Workaholism: This is an excessive devotion to work, driven by the need to earn more money, often at the expense of personal and family time.

- Financial Denial: This involves a refusal to acknowledge or deal with existing financial problems, like avoiding looking at bank statements or bills.

- Financial Enabling: This is repeatedly giving money to others even when it’s detrimental to one’s own financial health, often to maintain control or relationships.

- Financial Dependence: This is an over-reliance on others for financial support, with little or no effort to become financially self-sufficient.

- Financial Infidelity: This involves hiding or lying about financial matters to a partner or family member, leading to trust issues and relationship strains.

- Gambling Disorder: This is characterized by the compulsive need to gamble, often leading to severe personal and financial consequences.

Stay tuned for our next post, where we’ll shed light on a specific money disorder and its characteristics!

I hope this info was helpful!

Would you be willing to upload your receipts

( eg: grocery receipts) for an extra 1000 dollars per year?

You can earn more if you are a big spender, investor, or want

to complete tasks for them.

You can also get paid for things like putting a banner on your car.

– The platform is free to join.

– Paid out over 600 million since 2008

– Get cash back from anything from Trips to Vegetables.

– Side gigs and remote work/jobs available!

Visit this page and click the blue contact me button for more info. (An email will be sent)

Related:

Is Lack Of Money The Root Of All Evil

Narcissistic Personality Disorder