Independent Contractor Jobs: A Comprehensive Guide to Freelancing and Self-Employment

As the economy continues to shift towards a more flexible and remote work environment, independent contractor jobs have become increasingly popular. Freelancers, Digital Nomads, gig workers, and self-employed contractors have become a significant part of the workforce, offering a range of skills and services to clients in need. But what exactly is an independent contractor, and how is it different from being an employee?

What is an Independent Contractor?

An independent contractor is a self-employed individual who offers their services to clients or companies on a project basis. Unlike employees, independent contractors are not hired by a company and are not considered part of their staff. Instead, they work independently and are responsible for managing their own business and finances.

How is an Independent Contractor Different from an Employee?

The main difference between an independent contractor and an employee is that employees are considered part of a company’s staff and are subject to certain regulations and protections. Independent contractors, on the other hand, are considered self-employed and are responsible for managing their own business and finances.

Employees receive a regular salary or wage and are typically provided with benefits such as health insurance, paid time off, and retirement plans. Independent contractors, on the other hand, are paid on a project basis and are responsible for paying their own taxes and providing their own benefits.

Independent Contractor Jobs: A Growing Trend in the Gig Economy

With the rise of the gig economy, independent contractor jobs have become increasingly popular. Freelancers and self-employed contractors offer a range of services, from writing and design to consulting and project management. These individuals are often able to work remotely, offering their services to clients around the world.

One of the main benefits of working as an independent contractor is the flexibility it offers. Contractors are able to choose their own projects and clients, and can often set their own schedule. This allows individuals to work around other commitments, such as caring for children or pursuing other interests.

However, working as an independent contractor also comes with its own set of challenges. Contractors are responsible for managing their own business, which includes finding clients, negotiating contracts, and managing finances. They must also ensure they are complying with all relevant tax and legal regulations.

Work At Home Contractor

Working indoors may be unbearable for some. But it can be a launching board for bigger and better things.

“As we hibernate indoors and adapt to remote work, the bear’s resilience and resourcefulness can serve as a reminder to us all. “

Whether we are freelancers, entrepreneurs, or employees working under contract from home, we can learn from the bear’s ability to thrive in challenging environments.

By staying focused, organized, and adaptable, we can navigate the ever-changing landscape of remote work and emerge stronger on the other side, just like the bear emerges from hibernation with renewed energy and vitality.

So let us embrace our inner bear and face the challenges of contract work at home with determination and perseverance!

Types of Independent Contractor At Home Jobs

Independent contractor jobs come in many different forms, each requiring different skills and expertise. Some common types of independent contractor jobs include:

- Freelance Writer: Freelance writers offer writing services to clients, including articles, blog posts, and marketing materials.

- Freelance Designer: Freelance designers offer design services to clients, including website design, graphic design, and branding.

- Digital Nomad: Digital nomads are independent contractors who work remotely while traveling the world. They often offer a range of services, from writing and design to consulting and project management.

- Virtual Assistant: Virtual assistants offer administrative and organizational support to clients, including scheduling, email management, and social media management.

- 1099 Employee: A 1099 employee is an independent contractor who receives a 1099 tax form at the end of the year, rather than a W-2 form like traditional employees.

- Part-Time Contractor: Part-time contractors work on a project basis, but only work part-time hours.

- Part-Time Independent Contractor: Similar to a part-time contractor, part-time independent contractors work on a project basis but work fewer hours.

It is commonly believed that contractors reap the most financial benefit from working in the financial sector.

Set your own hours. Instant pay. More info

How to Become an Independent Contractor

Becoming an independent contractor can be a challenging yet rewarding career choice. It requires a unique combination of skills, experience, and business acumen to succeed in this line of work. To get started as an independent contractor, individuals must have a clear understanding of the industry they wish to work in and the services they plan to offer. Below are some key steps that can help individuals start their journey as an independent contractor:

- Identify Your Skill set: As an independent contractor, you’ll be selling your skills and expertise to clients. Start by identifying your core competencies and unique selling points that set you apart from your competition. Consider taking a skills assessment test to get an objective understanding of your strengths and areas for improvement.

- Choose Your Niche: The freelance world is a competitive space, and it’s essential to specialize in a particular area to stand out. Identify the areas in which you excel and build a reputation in those niches.

- Build Your Portfolio: As a contractor, your portfolio is your resume. Build a robust portfolio that showcases your skills and experience in your niche. Include testimonials and references from clients to add credibility to your portfolio.

- Set Your Rates: Determine your hourly or project-based rate. Consider your level of experience, niche, and the value you bring to your clients. Research the rates of your competitors and set your rates accordingly.

- Create Your Business Entity: You’ll need to register your business entity to operate as a contractor legally. Choose the most appropriate business entity type based on your business goals, such as an LLC, sole proprietorship, or S-corporation.

- Obtain Necessary Licenses and Permits: Depending on the industry and location you operate in, you may need to obtain specific licenses and permits to operate legally.

- Get Insured: It’s essential to protect your business and assets by getting insurance coverage such as general liability, professional liability, and worker’s compensation insurance.

- Build Your Network: Networking is a critical part of building a successful independent contracting business. Attend industry events, join online communities, and reach out to potential clients to build your network.

Becoming an independent contractor is not an easy task, but with a strategic approach and persistence, it is possible to build a successful career as an independent contractor.

Common Independent Contractor Questions and Answers

Here are some frequently asked questions (FAQs) related to independent contractors:

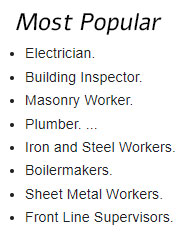

Q: What independent contractor job pays the most?

A: The pay for independent contractor jobs varies widely depending on the industry, experience, and skills required for the job. Some of the highest paying independent contractor jobs include management consulting, software development, financial advising, and healthcare consulting.

Q: What independent contractor form must be used by brokers in California?

A: In California, brokers are required to use the Independent Contractor Disclosure and Election form (RE 204) when hiring an independent contractor.

Q: What does independent contractor mean?

A: An independent contractor is a self-employed individual who provides goods or services to clients on a contract basis. Unlike an employee, an independent contractor is not subject to the same level of control by the boss/employer, and is responsible for their own taxes, benefits, and business expenses.

Q: What independent contractor makes the most money?

A: The highest earning independent contractors are typically those who work in industries with high demand for specialized skills or expertise, such as IT consulting, finance, engineering, or healthcare.

Q: What’s an independent contractor?

Q: What are independent contractors?

A: An independent contractor is a self-employed individual who works for clients on a contract basis, providing goods or services in exchange for payment. Independent contractors are responsible for their own taxes, benefits, and expenses, and are not considered employees of the boss/employer.

Q: What’s independent contractor UK?

A: In the UK, an independent contractor is a self-employed individual who works on a contract basis for clients, providing goods or services in exchange for payment. Independent contractors are responsible for their own taxes, benefits, and expenses, and are not considered employees of the cboss/employer.

Q: What’s a 1099 contractor?

A: A 1099 contractor, also known as an independent contractor or self-employed individual, is someone who works on a contract basis for clients and receives payment through a Form 1099-MISC, which reports the income earned from the boss/employer to the IRS.

Q: What is an independent contractor agreement?

A: An independent contractor agreement is a contract between a employer and an independent contractor, outlining the terms of their working relationship. The agreement typically includes details such as the scope of work, payment terms, and expectations for the contractor’s performance.

Q: When is an independent contractor an employee?

A: An independent contractor is not considered an employee. Independent contractors work on a contract basis and are not entitled to the same benefits and protections as employees.

Q: When to become an independent contractor?

A: Becoming an independent contractor may be a good option if you have a specialized skill set or expertise and want to work for yourself. It can also be a good option if you prefer a flexible schedule or want to have more control over your work.

Q: When do independent contractors pay taxes?

A: Independent contractors are responsible for paying their own taxes. They must pay estimated taxes on a quarterly basis and file a tax return at the end of the year.

Q: When do independent contractors get paid?

A: Payment terms for independent contractors are typically outlined in the contract. In some cases, payment may be made upon completion of the project, while in other cases, payment may be made in installments.

Q: When are independent contractors considered employees?

A: Independent contractors may be considered employees if they do not meet certain criteria, such as having control over how the work is done, providing their own tools and equipment, and having multiple clients.

Q: What to consider when hiring an independent contractor?

A: When hiring an independent contractor, it is important to have a written contract that outlines the scope of work, payment terms, and any other relevant details. It is also important to ensure that the independent contractor is properly licensed and insured.

Q: When is an independent contractor an agent?

A: An independent contractor may be considered an agent if they have the authority to act on behalf of the company they are working for. This may include the authority to enter into contracts or make decisions on behalf of the company.

Q: Where do independent contractors pay taxes?

A: Independent contractors are responsible for paying their own taxes, including federal, state, and local taxes. They typically pay self-employment tax, which includes Social Security and Medicare taxes, in addition to income tax. The specific tax laws and requirements vary depending on the country, state, and city in which the independent contractor operates.

Q: Where to report independent contractor income?

A: Independent contractors report their income on their personal tax returns, using IRS Form 1099-MISC. The client or company that hired the independent contractor will also file a copy of the 1099-MISC with the IRS, reporting the income paid to the contractor. This income must be reported even if the contractor did not receive a 1099 form from the boss/employer or company.

Q: Where to hire independent contractors?

A: There are several platforms and resources available for hiring independent contractors. Popular online platforms include Upwork, Freelancer, and Fiverr, which allow businesses and individuals to post job listings and connect with independent contractors from around the world. Networking events, job fairs, and professional associations are also great ways to meet independent contractors in person and learn more about their skills and experience.

Q: How are independent contractors paid?

A: Independent contractors are typically paid based on a project or assignment basis, rather than a regular salary or hourly wage. Payment can be made by check, direct deposit, or online payment platforms like PayPal or TransferWise.

Q: How do independent contractors pay taxes?

A: Independent contractors are responsible for paying their own taxes, including federal, state, and local taxes. They typically pay self-employment tax, which includes Social Security and Medicare taxes, in addition to income tax. Independent contractors can make estimated tax payments quarterly to the IRS and their state tax agency to avoid penalties.

Q: How to become an independent contractor?

A: To become an independent contractor, individuals must have a specialized skill set or expertise in a particular field, and must be willing to work on a project or assignment basis. They may also need to obtain any necessary licenses or certifications for their industry or profession. Networking, building a portfolio, and establishing a strong online presence can also help individuals find independent contractor opportunities.

Q: How much taxes do independent contractors pay?

A: Independent contractors typically pay a higher percentage of their income in taxes compared to regular employees, as they are responsible for both the employer and employee portions of Social Security and Medicare taxes. The specific amount of taxes an independent contractor pays depends on their income level and tax bracket, as well as the tax laws in their country, state, and city.

Q: How much do independent contractors charge?

A: The amount independent contractors charge for their services varies depending on the industry, the type of project, and their level of experience and expertise. Some independent contractors charge by the hour, while others charge a flat rate or a percentage of the project’s total cost. It’s important for independent contractors to research the market rates for their services and to set prices that are competitive and fair.

Q: How to define an independent contractor?

A: An independent contractor is a self-employed individual who provides services to clients or companies on a project or assignment basis. Unlike regular employees, independent contractors are not entitled to benefits or employment protections, and are responsible for paying their own taxes and managing their own expenses.

Q: Why is someone considered an independent contractor?

A: An individual is considered an independent contractor when they are self-employed and work for a company or person under a contract. Independent contractors typically have control over how they complete their work and may provide their own equipment, materials, or tools.

Q: Why become an independent contractor?

A: Becoming an independent contractor can provide more flexibility and control over your work schedule and projects. It can also lead to higher earning potential as you are able to set your own rates and negotiate contracts with clients.

Q: Why are Uber drivers independent contractors?

A: Uber drivers are classified as independent contractors because they have control over their work schedule, they use their own vehicles, and they are not directly managed by Uber. However, the classification of Uber drivers as independent contractors has been a subject of debate and legal challenges.

Q: Why can’t independent contractors unionize?

A: Independent contractors are not considered employees and therefore do not have the legal right to form a union. However, they may still have the ability to negotiate their rates and working conditions through contract negotiations.

Q: Why hire independent contractors?

A: Hiring independent contractors can provide more flexibility for employers as they are not responsible for providing benefits or paying employer taxes. Additionally, employers can hire independent contractors for short-term projects or to fill specific skill gaps without committing to a long-term employment relationship.

Q: How much do independent contractors pay in taxes?

A: Independent contractors are responsible for paying both the employer and employee portion of their Social Security and Medicare taxes, which amounts to 15.3% of their income. Additionally, they are responsible for paying their own income taxes based on their earnings.

2023 Best Paying Contracting Job

It is commonly believed that contractors reap the most financial benefit from working in the financial sector.

Many contractors in the financial sector have the option of instant pay, which can be a significant benefit. This means that they receive payment immediately upon completing a project or task, rather than having to wait for a bi-weekly or monthly paycheck. This can help contractors to better manage their cash flow and maintain a steady stream of income.

contractors in the financial sector can also receive passive or residual income. They can do the job one time and get paid over and over.

Sound interesting? Partners wanted. No special skills or experience required. Residual income. Work from home or on the go. More info: Contractor Jobs

Popular Links:

- Working from Home and Digital Nomads

- How To Make Money As An Attractive Female

- Be Your Own Boss Work From Home

- Get Wealthy Building Your Own Online Home Business

- How To Start A Smart Home Business

- Business That Runs Itself

- An Entrepreneur Would Most Likely Be Interested In

- Get Wealthy Building Your Perfect Business

- Online Home Business VS Legitimate Work At Home Opportunities