Secrets to Know About Earning on Day 1

Registration link with $10.00 bonus offer/link to Swagbucks

1. Take the profile quiz.

It takes 3-5 minutes. Many members skip this survey because it pays 25 SB. But by completing this survey, Swagbucks will have a member profile for you and know basic information like your age, zip code, living situation, and employment status.

With this information, Swagbucks can show you relevant surveys and earning opportunities. If you don’t complete the Profile Quiz, you’re leaving money on the table and you’ll get fewer earning opportunities.

After you complete the short profile quiz, you’ll be prompted to verify your account. You can verify your account by email . After you log into your email verify your account (it takes 20 seconds), you’ll earn an additional 5 SB. Earn 100 SB for installing and logging into the app

Total SB Earned: 30 SB ($ 0.30)

2. Complete the other free offers and you’ll be at $1.60.

- Sign up for Morning Brew daily email. Sign up confirm your email and open the first 2 emails, get 65 SB. Get Morning Brew.

- Play “Luck is On Your Side”, a fun coin-collecting app game. Signup with valid info, and get 25 SB.

- Join Exxon Mobile Rewards+. Earn points for saving at the pump. Get the app and create a free account and get 30 SB. Get Exxon Mobile Rewards now.

- Add your first grocery item. Just select an item to add to your grocery list. Just click or tap “+ Add to List” and you’ll earn 10 SB.

Total SB Earned: 125 SB ($ 1.60)

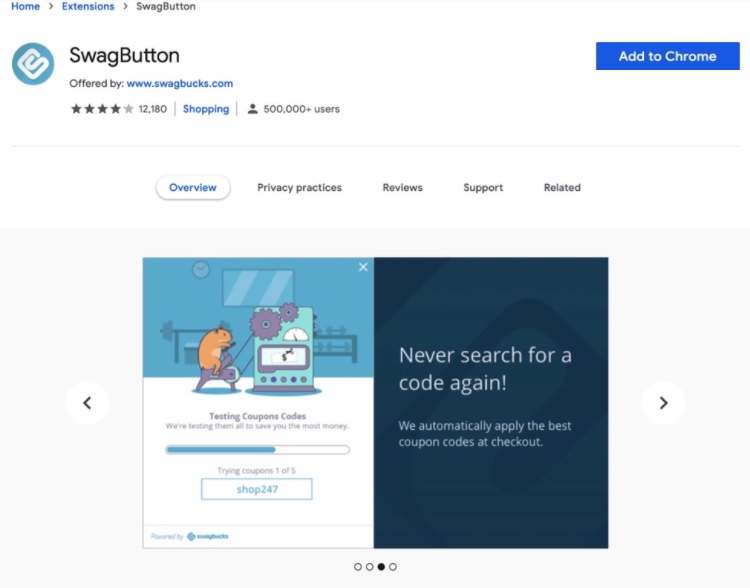

3. Add the SwagButton.

The SwagButton is a free app extension you add to Chrome. You can add it in just 2 clicks and you’ll get 25 SB.

The SwagButton is featured in the list of offers you see right after signing up, but since it has a lot of functionality I wanted to call it out in its own section here. The SwagButton enables you to automatically save money and earn cash back anywhere on the web.

This means that when you’re online on a shopping or eCommerce site, you’ll be notified of any sales or promo codes that are available for that retailer. This includes cash back rebates from Swagbucks.

Total SB Earned: 210 SB ($2.10)

4. Get Your Free Credit Score from SoFi

Get your free credit score from SoFi. Get your free score and credit insights, plus earn 1,000 SB ($10) when you complete your score check and register. Get SoFi now.

Total SB Earned: 1,210 SB ($12.10)

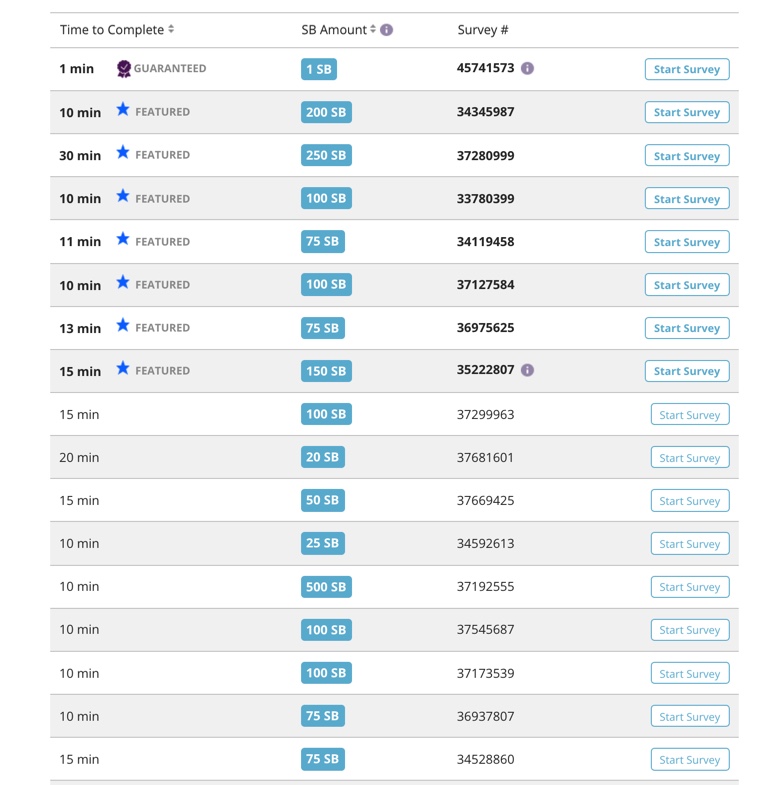

5. Attempt at least 5 surveys.

You can find surveys in the “Answer” section of Swagbucks.

Featured surveys are surveys that Swagbucks believes may be the best fit for you based on the profile data they have. This does not mean that you will qualify for that survey though.

In order to earn the Swagbucks points or Swagbucks rewards in SB for a survey, you must qualify for the survey and complete it in full.

Different survey companies who work with Swagbucks set their own qualification requirements and will create a pre-screener. You will not be able to qualify for every survey, but Swagbucks wants to encourage you to at least try. Earn an SB reward even when you disqualify, up to 5 SB per day.

If you attempt at least 5 surveys, you should be able to complete at least a couple of them. And even if you disqualify from every single one, you’ve still made 5 SB for free.

Total SB Earned: 1,300 ($ 13.00)

(Assumes at least 90 SB in earnings from attempting 5 surveys.)

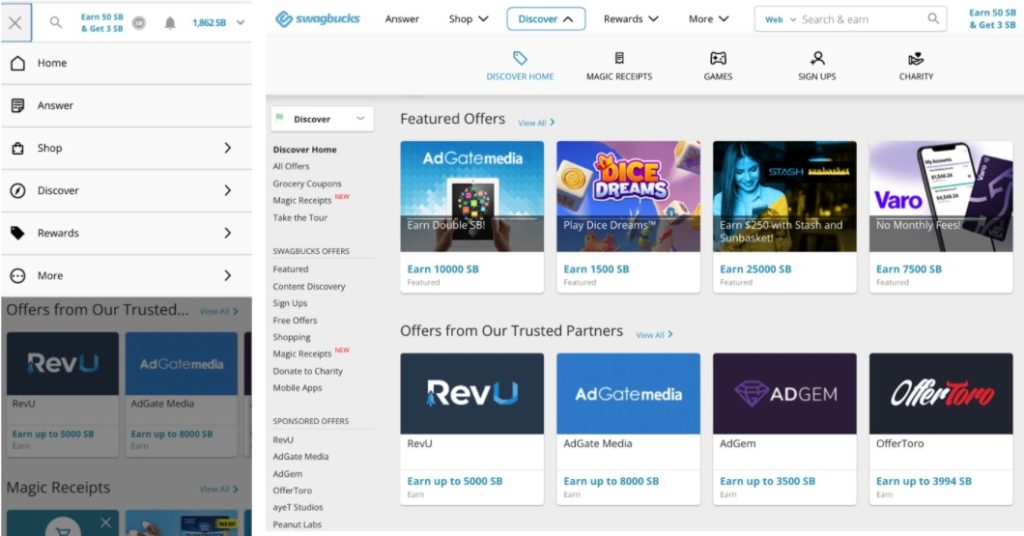

6. Discover New Products and Services and Earn Swagbucks

The Swagbucks “Discover” section is full of different offers (products and services) to discover.

- Products – Get free products (samples) or exclusive discounts on free services. In addition to the discount, there is also an SB bonus you will be awarded too as a thank you for trying the product.

- Services – Sign up for free services (free trial periods or introductory rates, free apps, etc.) and earn SB. This can include subscription boxes, banking apps, movie and TV streaming services, and more.

- Apps – Install new apps and earn rewards. For some apps, you can get paid just for installing the app and opening it or registering. For other apps, especially gaming ones, there’s a prize for making it to a certain level or reaching a certain number of points.

- Sweepstakes – Earn Swagbucks points to enter drawings and sweepstakes, like the AARP Rewards sweeps for a chance at a $1,000 prize.

- Newsletters and eBooks -Earn a Swagbucks reward for signing up for eNewsletters (i.e. Pilsbury) or for eBooklets.

The available Swagbucks offers are always changing, but visit the Swagbucks Offers page and you’re to find a great mix of free offers and discounted deals to check out.

Top Free Swagbucks Offers to Complete Right Now

Here are the top Swagbucks offers, all free, you can complete them now and top up your cash rewards.

- Get 100 SB ($1.00) when you get a free Liberty Mutual insurance quote. Get paid to see if you can save money. No purchase required. Get Liberty Mutual.

- Get 200 SB ($2.00) when you get a free quote for a vision plan with VSP. No purchase required. Get VSP.

- Get 250 SB ($2.50) for getting your free life insurance quote from everyday life. No purchase is required.

- Get 50 SB ($0.50) for signing up for the Mucinex (Mucus Fighters+) newsletter. Get the Mucinex newsletter now.

- Get 100 SB ($1.00) when you sign up for the 5 Important Nutrients eBook (Quality Health).

- Get 40 SB ($0.40) when you sign up for free samples from TryProducts. Get TryProducts.

- Get 25 SB ($0.25) when you sign up for the Athletic Brewing newsletter. Get Athletic Brewing newsletter.

- Get 500 SB ($5.00) when you sign up for Marble and create your free account. Marble finds ways you can earn cash back on the insurance policies you already have. Sign up and link your first policy to get $5. Get Marble.

- Get 200 SB ($2.00) when you sign up for Box Tops for Education, the General Mills app that lets you scan barcodes and receipts to earn free rewards for school. Install the app and complete 1 scan, and earn $2 free. No purchase required. Get Box Tops.

- Get 300 SB ($3.00) to sign up for emails from the AARP’s free loyalty program. Sign up, click the SMS link, and opt-in. You’ll get $3 free. Get AARP Rewards.

- Get 1000 SB ($10.00) to download the free Upside app, sign up, and enter the promo code AFF25 to save $0.25/gallon cash back reward on your next gas purchase. Upside is the gas app that helps you save money on gas. Get Upside now.

- Get 400 SB ($4.00) to post your resume on ZipRecruiter. ZipRecruiter is a free job board with over 1 million job listings. Sign up and apply for at least 1 job, get $4.00. Sign up for ZipRecruiter now.

- Get 250 SB ($2.50) to sign up for Credit Karma and get your free credit score, plus earn $2.50 free. Get Credit Karma.

- Get 100 SB ($1.00) for watching videos. Download the free Pococha video app and watch 5 minutes of video to earn $1.00. Try the Pococha offer now.

- Get 1000 SB ($10.00) for checking out the Pococha app. After downloading the free Pococha video app and watching 5 minutes of video, log in every day for 8 days and earn an additional $10. Try the Pococha app now.

Complete all of these free Swagbucks offers, you can earn 4,515 SB or $45.15. Some of these offers may take 7 or more days to credit, but if you complete them, the funds will appear in your Swagbucks account.

In addition to the offers in this list, there are dozens of more free offers you can complete on Swagbucks to earn anywhere from 2 SB to 10,000 SB (2-cents to $100). Many of these offers are related to signing up for free apps, free newsletters, or free games.

Total SB Earned: 5,815 SB ($ 58.15)

7 Redeem Swag Codes

Swag codes are promotional codes. They’re string of letters or words that you can redeem on the Swagbucks website.

New Swag codes are released daily. Most Swag codes are worth 2-3 SB. You can find Swag Codes on the Swagbucks homepage, in the Swagbucks blog, on the Swagbucks social media feeds like their Instagram page or Facebook account.

Redeem Swag Codes every day for a week, you could earn 15 SB.

Total SB Earned: 5,830 SB ($ 58.30)

8 Answer Survey Profile Poll Questions

Answering survey profile questions is an easy way to top up your earnings.

These questions are asked poll style. Anyone can earn for answering these questions; there are no survey qualification requirements.

Earn 2B for every 10 short questions you answer. Answer 10 sets in one day, and earn 20 SB. Do 10 sets every day for a week, that’s 140 SB. And as you answer these profiles, you’re enhancing your Swagbucks profile so that you can be shown more opportunities to earn money on Swagbucks.

Total SB Earned: 5,970 SB ($ 59.70)

Earning Your First $50 Free on Swagbucks

Step by step, with links and screenshots, we’ve gone over how you can earn your first $50+ for free on Swagbucks without having to spend money. (Some of the offers, for example, are cash back rebates for a percentage of your shopping spend.)

Swagbucks has different categories or channels for you to earn money and gift cards every day, on the Swagbucks.com website or in the Swagbucks mobile app.

Free Ways to Earn $50 that We’ve Covered in This Article

- Swagbucks Answer: Answer surveys 5 minutes to 60 minutes in length or answer short profile survey polls.

- Swagbucks Rewards: Redeem Swag Codes.

- Swagbucks Discover: Explore Swagbucks’ offers of new products and services. Earn rewards when you install apps, try free samples, play games, sign up for newsletters, or more.

Other Popular, Easy Ways to Earn Money and Gift Cards on Swagbucks

There are other popular, easy ways to earn money on Swagbucks for everyday purchases you’re already making – at grocery stores and supermarkets and for online shopping.

Online Shopping

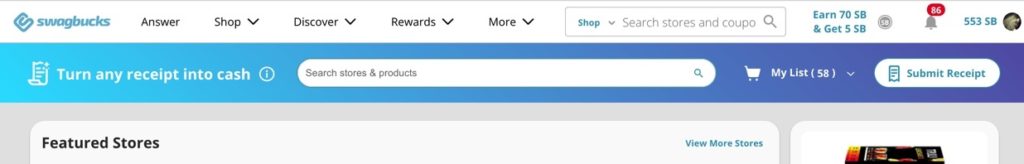

Earn cash back rebates for shopping at any of 10, the 000+ featured stores in the Swagbucks “Shop” portal. Visit the “Shop” tab or section. Or in the top search bar, select the retailer you want to shop.

Shop at a featured retailer, like Home Depot, and earn cash back rebates on your purchase of up to 12%. And when you make your first purchase of $25 or more at a featured retailer, you’ll get a one-time $10 (10,000 SB) cash bonus.

This is an exceptionally good deal. With over 7,000 featured stores, basically, any and every store you can think of is in the Swagbucks shopping portal. And with odds at pretty much 100% that you’re going to spend at least $25 or more again at some point this month, you’re basically getting $10 for free.

If you have the SwagButton installed, there’s no need to visit Swagbucks before visiting the merchant’s website. Just visit the merchant’s page and the SwagButton will alert you to the cash back and coupon deals available, and just tap or click to apply the savings.

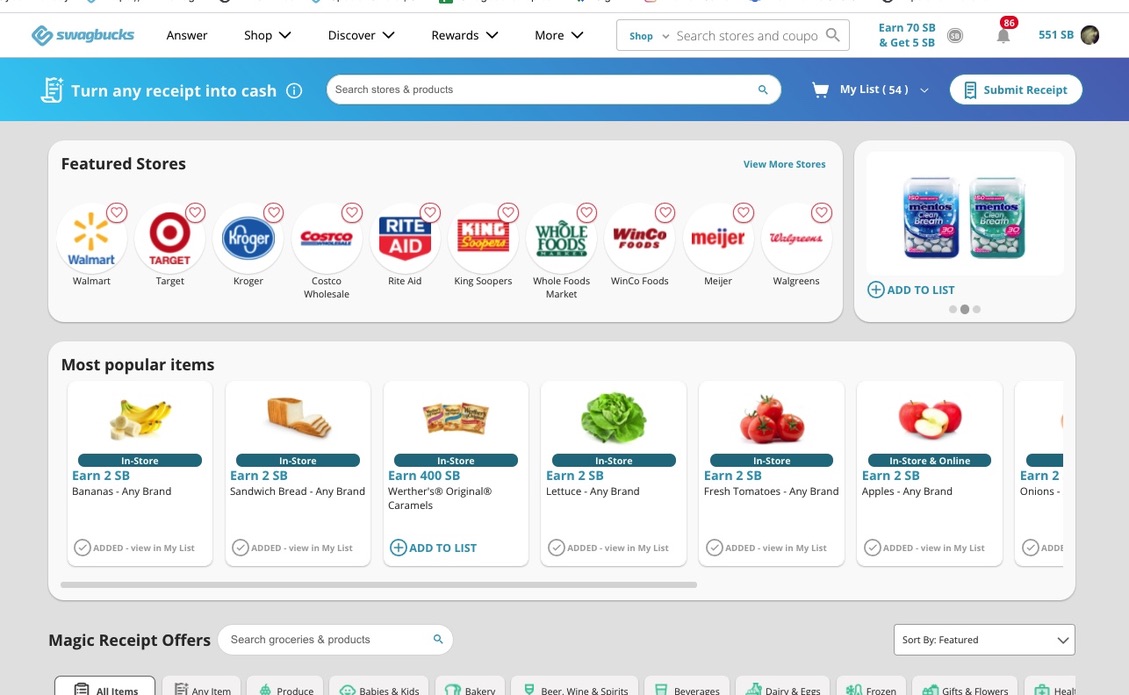

Grocery Store and Supermarket Shopping

It’s all easy to earn Swagbucks rewards for in-store shopping.

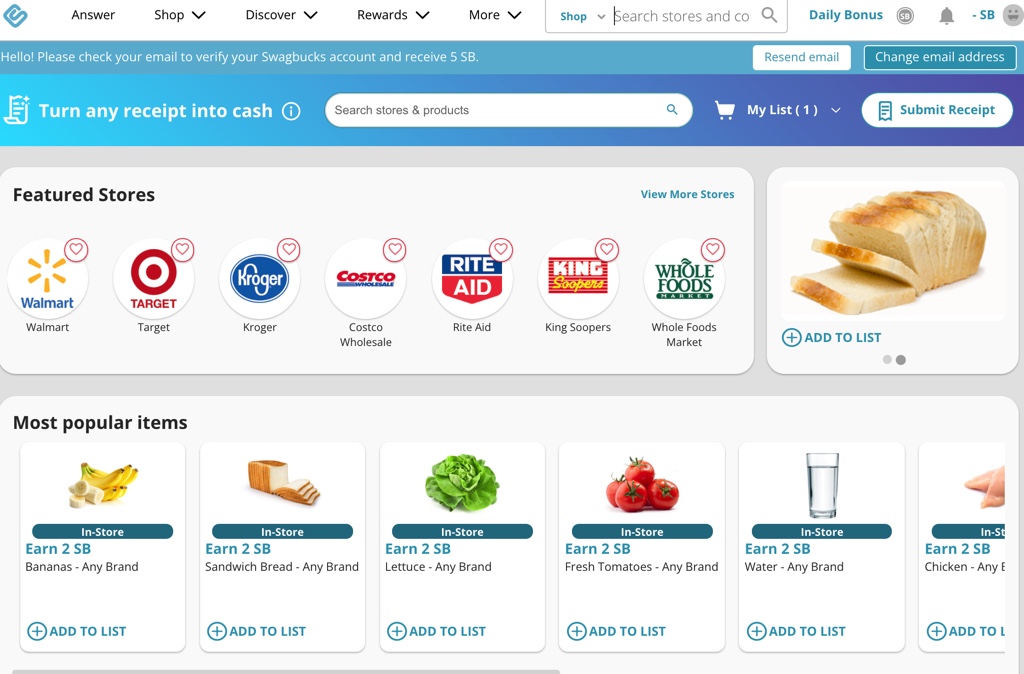

Visit “Magic Receipts” in the Swagbucks “Shop” tab, and you’ll see a number of different in-store offers. Purchase any of these featured supermarket items, and earn cash back.

There are dozens of featured products (well over 100 at any given time), and the great thing is you can save money buying everyday things that you’re already buying.

Many grocery receipt apps will only let you earn points in their mobile app for buying very specific items, like tinned sardines or a box of drugstore chocolates you have no use for.

Swagbucks rewards you for buying specific brand products (like Mentos, Mrs. Butterworth, Oxiclean, or Arm & Hammer), or for buying generic kitchen staples.

Earn cash rewards for buying any-brand staples like eggs, bread, potatoes, onions, lettuce, bananas, avocados, and more.

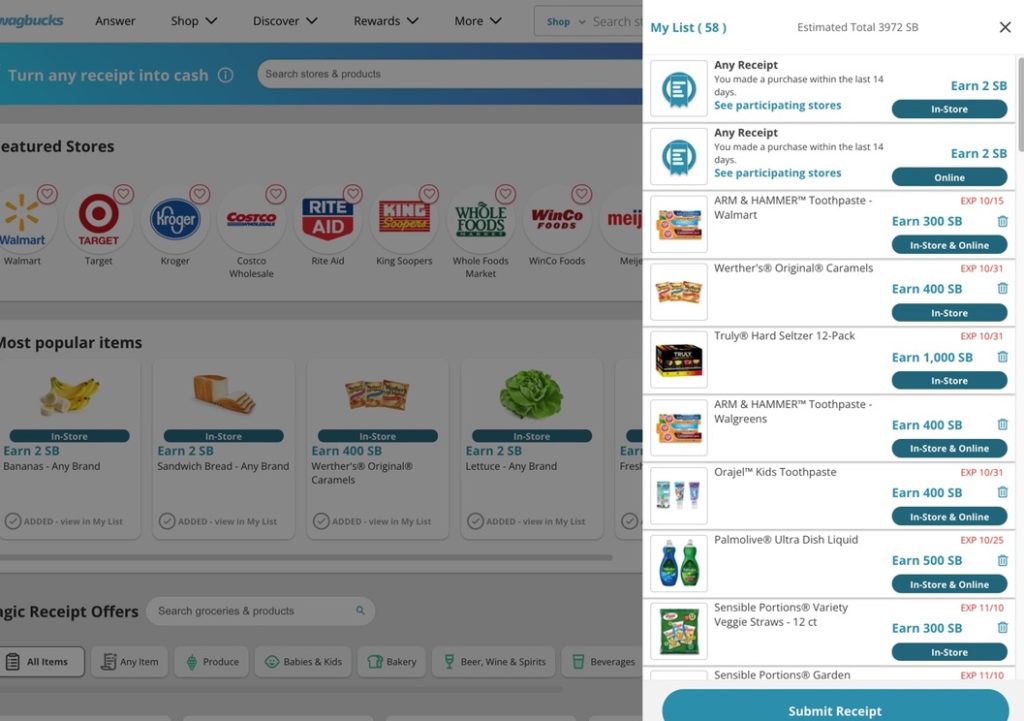

Go through and add the offers you like to your list.

Just click or tap “+ Add to List”.

Once your shopping trip is complete, and you have your supermarket receipt, you can redeem your earnings.

Select “My list” by your account profile settings.

Then, review your list to make sure all the items are there and select “Submit Receipt”.

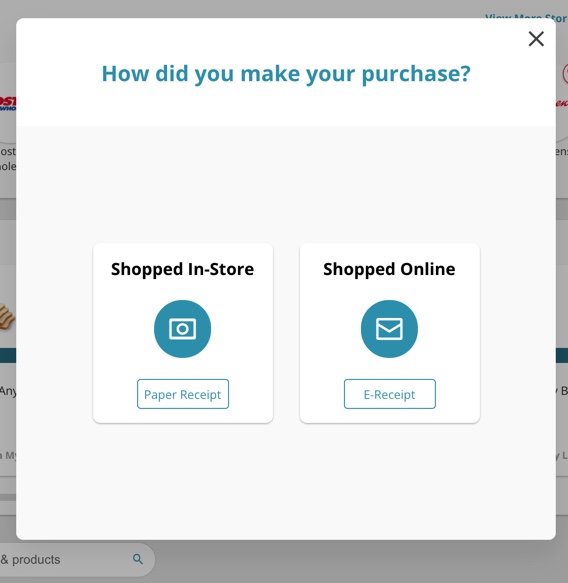

Specify whether or not you shopped in-store or shopped online. (Some Magic Receipts offers are for online-only purchases.)

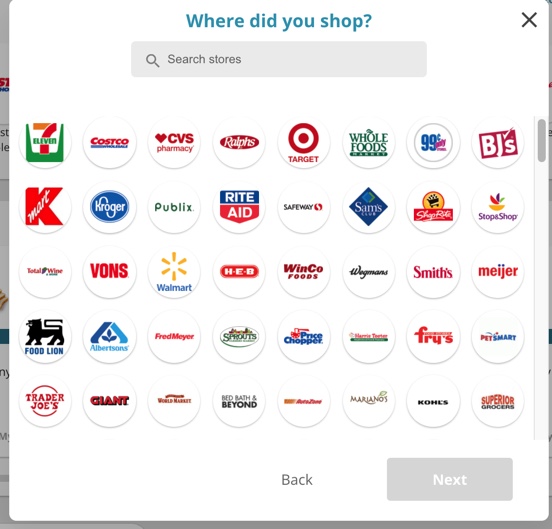

Select the store where you shopped.

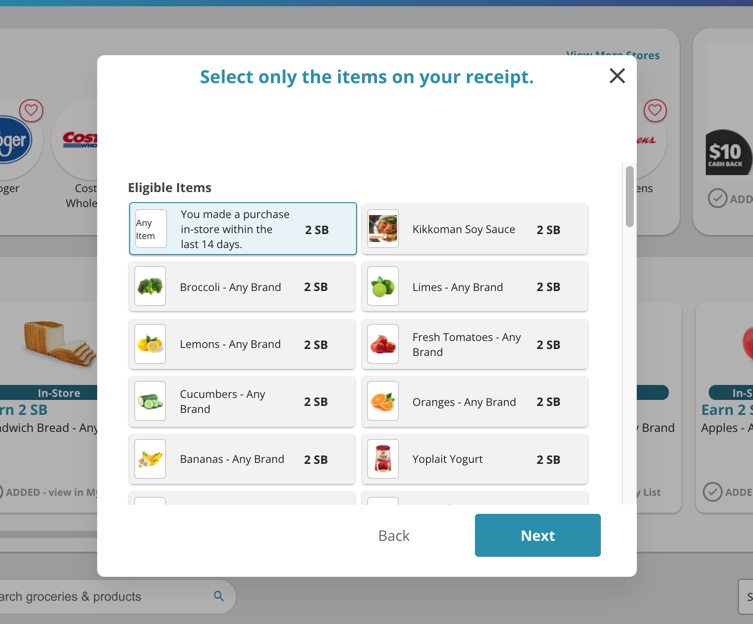

Then select only the items on your list that are on your receipt.

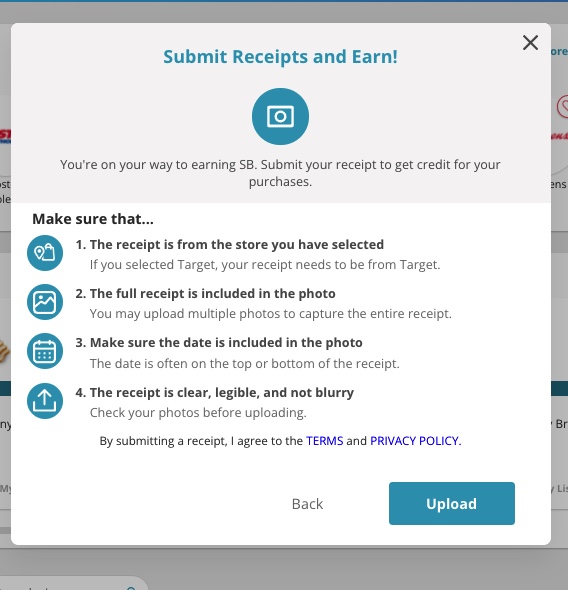

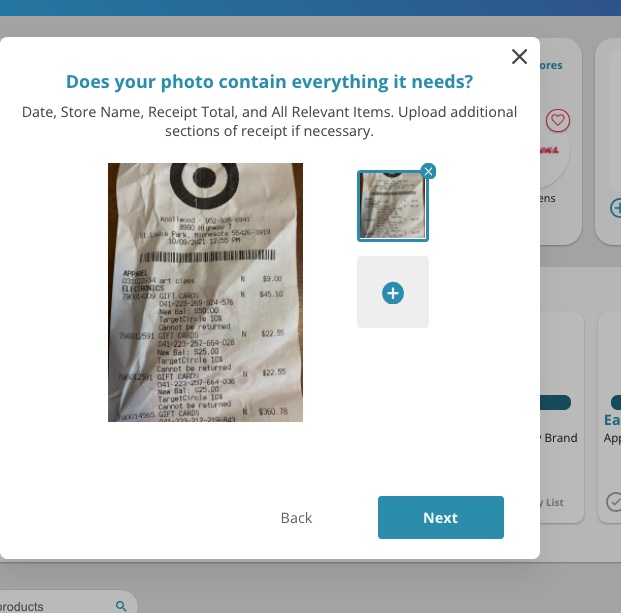

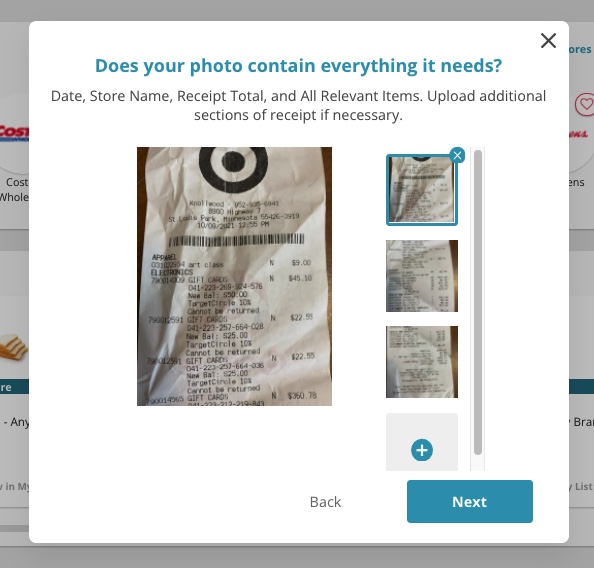

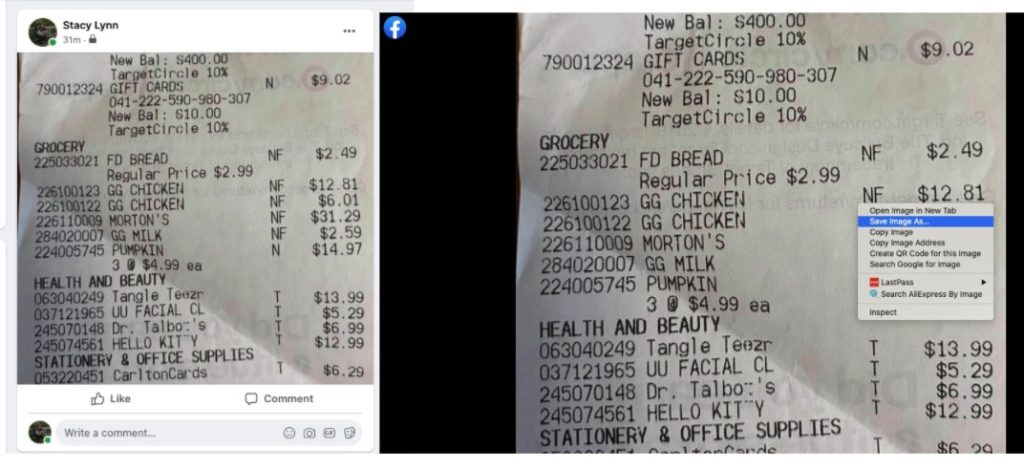

Next, upload your receipt. Make sure the photo of your receipt contains: the date, store name, receipt total, and all eligible items including item description and item purchase amount.

Your receipt will be scanned. If eligible items were purchased and your receipt is legible, you will be notified that your receipt was successfully read and that your Swagbucks account will get credited.

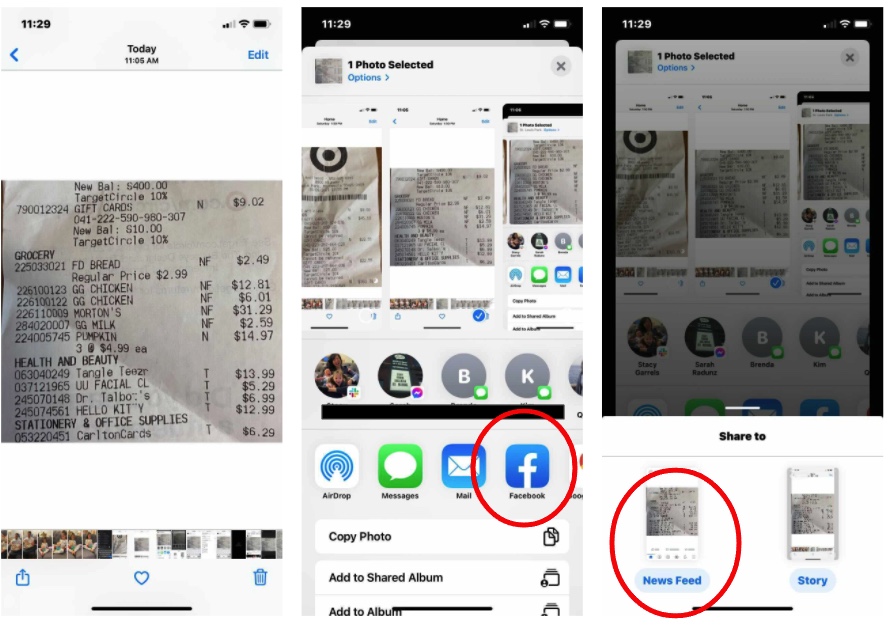

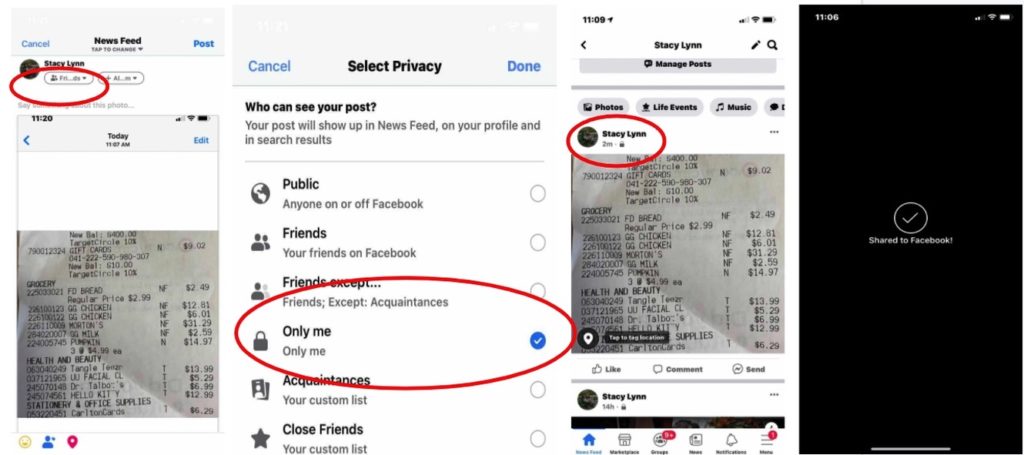

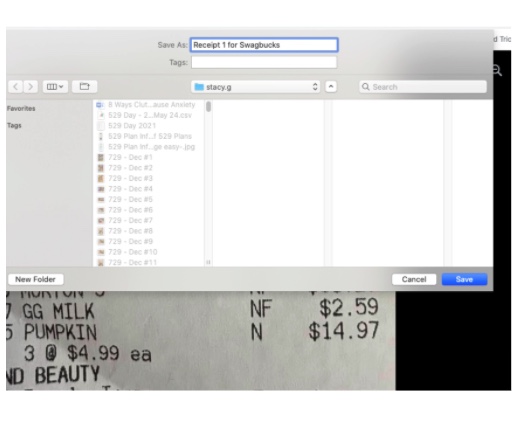

How to Submit a Receipt with a Laptop, Desktop, or Tablet

Using the camera on your phone, take a picture of the entire receipt. Make sure the image fits the full width of your screen. Include the store name, total price, and all products purchased with both the product name and description and price.

You may need to take multiple shots to get all of the receipt information.

Next, you need to transfer this information to your laptop, desktop, or tablet. There are quite a few options, but these are two of the easiest ones.

- Email yourself these images from your phone. Then open the email on your machine, and right-click to save them to your machine.

- Save the image to Facebook. Post the image on Facebook. Then go to your Facebook account and immediately save the image to your machine. You can delete the image afterward. If you want, when you post the image you can adjust the settings so that only you can see the post.

Final Thoughts on Earning Money and Gift Card Rewards with Swagbucks

Whether it’s your 1st day or 1,000th day as a member of Swagbucks, these step-by-step tips we’ve outlined are bound to help you max out your earnings on Swagbucks.

Anyone can get to their first $50+ in earnings on Swagbucks for free within a week or two. And if you make Swagbucks a daily habit, you can see your Swagbucks earnings catapult to diamond-level ($20K+) status.

Any promotions and associated rewards featured in this article were current at the date of the article’s publication. Any and all Swagbucks promotional offers are subject to modification.

I set up a new email address for Paypal and did a $50 Swagbucks withdrawal in the first video

Once set up – withdrawing to Paypal only takes one minute

Of course we have many options. Virtual debit cards, gift cards, Bitcoin to CasApp etc…