Budgeting got you feeling stuck? Stuck between ramen noodles and that dream vacation? Fear not, financial warrior! This treasure trove of tips is packed with hacks and strategies to tackle any budgeting obstacle. We’ll show you how to squeeze more juice out of every dollar, conquer hidden spending monsters, and finally reach your financial goals with a flourish

Crafting a Timeline for Success: The Power of Deadlines

Ever embarked on a journey without a map? It’s the same with budgeting! Setting clear deadlines injects your plan with the power of focus and momentum. Think of them as mile markers on your road to financial freedom, propelling you forward. Here’s how deadlines can supercharge your budgeting process:

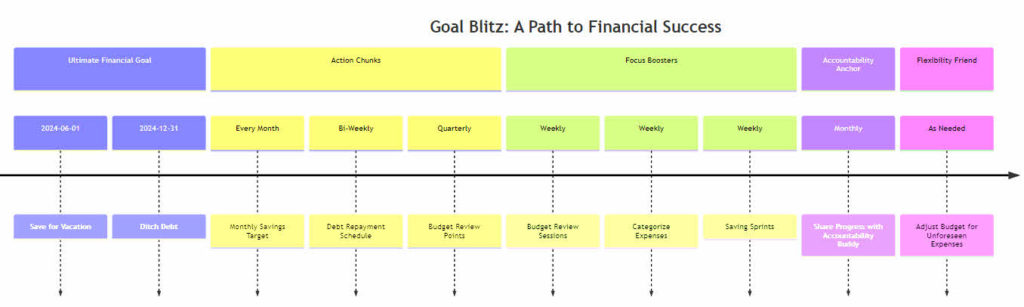

- Goal Blitz: Start by anchoring your timeline with your ultimate financial goal. Whether it’s saving for a vacation by summer or ditching debt by year-end, this deadline becomes your North Star.

- Action Chunks: Break down your overarching goal into smaller, bite-sized milestones. Think monthly savings targets, debt repayment schedules, or key review points for your budget. Each deadline creates a mini-victory, keeping you motivated and on track.

- Focus Boosters: Deadlines inject your journey with urgency, helping you prioritize tasks and avoid procrastination. Schedule budget review sessions, categorize expenses weekly, or set weekly saving “sprints” – deadlines keep you laser-focused.

- Accountability Anchor: Sharing your deadlines with friends, family, or even a financial accountability buddy adds an extra layer of motivation. The knowledge that someone’s watching can keep you committed and celebrate your wins along the way.

- Flexibility Friend: Life throws curveballs, and your budget should be no different. Build in some wiggle room within your deadlines, allowing for adjustments if needed. Don’t see unforeseen expenses as derailments, but opportunities to adapt and revise your timeline.

Remember, deadlines are your guiding lights, not rigid chains. Use them to structure your journey, celebrate progress, and ultimately reach your financial goals with speed and confidence. So, grab your calendar, plot your milestones, and let’s watch your budget blossom under the power of deadlines!

Building Flexibility: The Role of Contingency Plans

Life’s a wild ride, and budgets – even the best ones – need to be ready for the occasional pothole. Enter the contingency plan, your financial superhero against unexpected expenses and curveballs. Let’s build that safety net together, brick by financial brick:

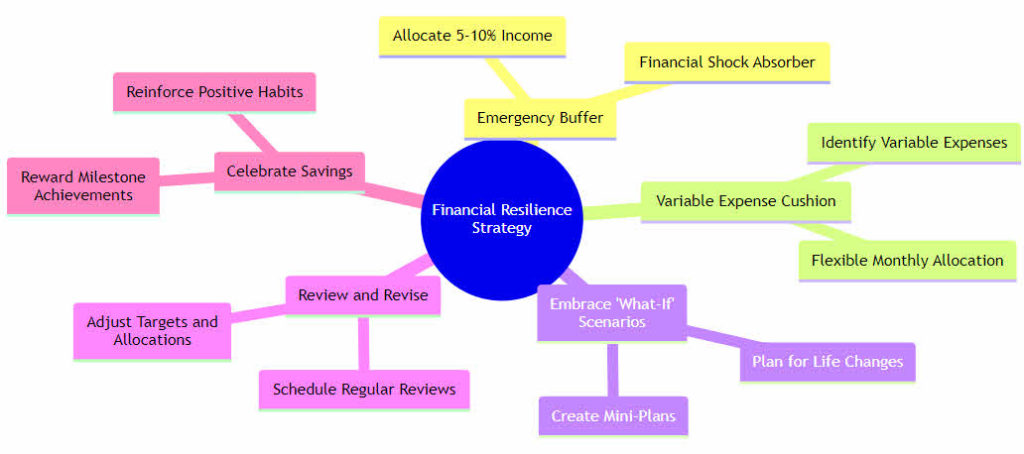

- Emergency Buffer: Life happens. That leaky roof or surprise medical bill shouldn’t derail your journey. Allocate a percentage of your income (5-10% is a good starting point) to an emergency fund, your financial shock absorber.

- Variable Expense Cushion: Not all months are created equal. Give your budget some breathing room by identifying variable expenses like entertainment or dining out. Allocate a flexible monthly amount, adjusting it as needed to adapt to your spending patterns.

- Embrace “What-If” Scenarios: Think ahead! Play out potential life changes – job loss, car repairs, even those dream vacations – and create mini-plans for managing each scenario within your existing budget. It’s like financial pre-gaming!

- Review and Revise: Budgets aren’t set in stone. Life unfolds, so your budget should too. Schedule regular reviews (monthly, quarterly, or as needed) to assess your progress, adjust targets and allocations based on unforeseen expenses or changed priorities.

- Celebrate Savings: Hitting your contingency plan targets deserves a pat on the back! Not only are you building financial security, but you’re also proving your adaptability. Treat yourself to a small reward for each milestone reached, reinforcing positive budgeting habits.

Remember, contingency plans aren’t about fear; they’re about empowerment. By embracing flexibility and preparing for the unexpected, you’re giving yourself the freedom to ride life’s rollercoaster without financial anxieties. So, build your safety net, adjust your sails, and enjoy the journey – your budget is ready for anything!

Fostering Collaboration: Engaging Key Stakeholders

Forget the financial loner act! Budgeting thrives on collaboration. Think of it like conducting a financial symphony, where everyone’s unique perspective harmonizes into a beautiful budget masterpiece. So, let’s grab our instruments (figuratively speaking) and welcome onboard these key stakeholders:

- Department Duets: Partner with department heads and finance teams. Their firsthand knowledge of expenses and needs adds invaluable depth to your budgeting melody.

- Goal Groove with Management: Get your leadership in the loop! Share your goals, explain budgeting decisions, and seek their guidance. Their buy-in ensures your budget plays in tune with the company’s overall rhythm.

- Employee Ensembles: Don’t underestimate the power of the rank-and-file! Incorporate feedback from employees through surveys, meetings, or suggestion boxes. Their experiences can reveal hidden spending inefficiencies or suggest cost-saving ideas.

- Cross-Functional Choruses: Collaborate with other departments! Sharing resources, pooling data, and aligning goals across functions can create a truly unified budgetary symphony.

- Feedback Funicular: Communication is key! Keep everyone informed on budget progress, celebrate milestones, and address concerns collaboratively. This transparency builds trust and keeps everyone humming the same financial tune.

Collaboration isn’t just about adding voices; it’s about creating harmony. By engaging key stakeholders, you tap into diverse perspectives, foster ownership, and build a budget that works for everyone. So, raise your financial baton, conduct with inclusivity, and watch your collaborative budget masterpiece come to life!

Refining Your Financial Melody: The Power of Regular Budget Reviews

Think of your budget as a musical masterpiece, ever-evolving to reflect your life’s changing rhythm. The secret to financial harmony lies in regular reviews and adjustments – the keynotes of success! Let’s explore this crucial cycle:

- Monthly Metronome: Schedule monthly budget check-ins, like a financial pit stop. Compare actual spending to your targets, analyze variances, and adjust accordingly. It’s like checking your tuning every month to ensure your budget stays pitch-perfect.

- Quarterly Cadence: Every quarter, conduct a deeper analysis. Dive into spending patterns, identify areas for improvement, and celebrate milestones. Think of it as a mini-concert review, refining your financial performance and planning for the next movement.

- Life’s Improvisations: Be ready to adapt! Unexpected expenses or changed priorities are like musical interludes, requiring impromptu adjustments. Don’t panic – embrace flexibility and revise your budget to maintain financial harmony.

- Goal Guardian: Regularly revisit your long-term financial goals. Are you still on track? Do they need recalibration to reflect life changes? This ensures your budget stays aligned with your financial dreams, the ultimate melody you’re composing.

- Celebrate Crescendos: Don’t forget to pat yourself on the back! Hitting savings targets or successfully navigating financial challenges deserves acknowledgement. Celebrate your progress, like an encore after a successful performance, reinforcing positive budgeting habits.

Regular reviews aren’t about punishment; they’re about empowerment. By embracing the cycle of improvement, you’re keeping your budget dynamic and adaptable, ready to harmonize with life’s unpredictable yet beautiful melodies. So, pick up your financial instrument, embrace the reviews, and enjoy the sweet music of financial success!

Tech Time! Supercharge Your Budget with a Digital Sidekick

Forget manual calculations and dusty spreadsheets! Embrace the cutting edge of financial management – budgeting software. Think of it as your trusty financial co-pilot, helping you navigate towards your financial goals with ease and efficiency. So, buckle up and explore the techy tools that can revolutionize your budgeting game:

- Expense Automaton: Ditch the manual data entry! Many apps automatically track your spending, categorize transactions, and generate insightful reports. Let technology do the heavy lifting, freeing up your time for strategic planning and goal-setting.

- Budget Balance Beam: Worried about overspending? Budgeting software helps you set spending limits, track progress towards goals, and receive alerts when you’re nearing your boundaries. It’s like having a financial tightrope walker keeping you steady on track.

- Insightful Visionary: Uncover hidden patterns in your spending with advanced analytics tools. These apps categorize expenses, show trends over time, and identify areas for potential savings. Think of it as your financial X-ray, revealing hidden opportunities for optimization.

- Collaboration Connection: Sharing your budget journey doesn’t have to be a solo act. Many apps allow you to collaborate with partners or family, monitor joint goals, and share spending insights. It’s budgeting with a built-in support system!

- Automation Aficionado: Schedule transfers, pay bills automatically, and automate recurring savings goals. Budgeting software becomes your financial autopilot, allowing you to set it and forget it, while your finances move towards your dreams.

Technology isn’t about replacing your financial savvy; it’s about amplifying it. By leveraging the power of budgeting software, you can streamline tasks, gain valuable insights, and make smarter financial decisions. So, embrace the tech revolution, choose your digital co-pilot, and watch your budget soar to new heights!

In Conclusion: Mastering the Budgeting Process for Financial Empowerment

Ever stared at your bank account with a mix of hope and confusion? Join the club! But listen, friend, mastering your budget isn’t about being a math whiz or a finance guru. It’s about taking small, smart steps, like setting manageable deadlines, collaborating with those around you, and leveraging the magic of budgeting apps. These tips are your personalized toolkit, helping you transform your “maybe someday” goals into tangible realities. So, ditch the financial stress and embrace the empowerment! You’ve got this, budget warrior, and we’re here to cheer you on every step of the way.

Tired of just browsing? Start earning

Unlock your financial aspirations with a smart online platform that rewards you everyday. This platform offers an innovative way to bolster your savings, helping you inch closer to your financial goals and objectives, one rewarding task at a time. Email me for the link and guide: kristal@coachkristal.com

Setting Financial Goals and Objectives

Gathering and Analyzing Financial Data

Related:

All About How Childhood Shapes Our Financial Future

Top 5 Financial Discipline Tips