Top 5 Money Management Solutions: A Personal Journey

Managing money effectively can be a challenging yet crucial task. I’ve always believed in making my time count and helping others do the same. So, I embarked on a journey to find the best money management solutions, and I’m eager to share my discoveries with you.

Why Money Management is Key to Unlocking Life Freedom

Like many of you, I admire Robert Kiyosaki’s philosophy in “Rich Dad, Poor Dad”. It’s not just about earning money; it’s about making it work for you. This realization is the first step in unlocking a life of freedom and success.

Forget chasing dollars, chase control. True wealth lies not in how much you make, but in how much you keep and how hard it works for you. Unleash your life’s potential by mastering money, not serving it. Remember, freedom lives on the other side of financial literacy.

The Quest for the Best: How I Found the Top Money Management Solutions

I scoured the internet, read countless reviews, and compared various tools and strategies. The goal? To find easy, efficient, and cost-effective ways to manage money.

Forget buried treasure maps; my quest was digital, unearthing the best money management tools. Endless reviews, tool battles, and strategic sifting – all for one prize: financial ease, efficiency, and affordability. Turns out, the gold wasn’t hidden, just waiting to be discovered.

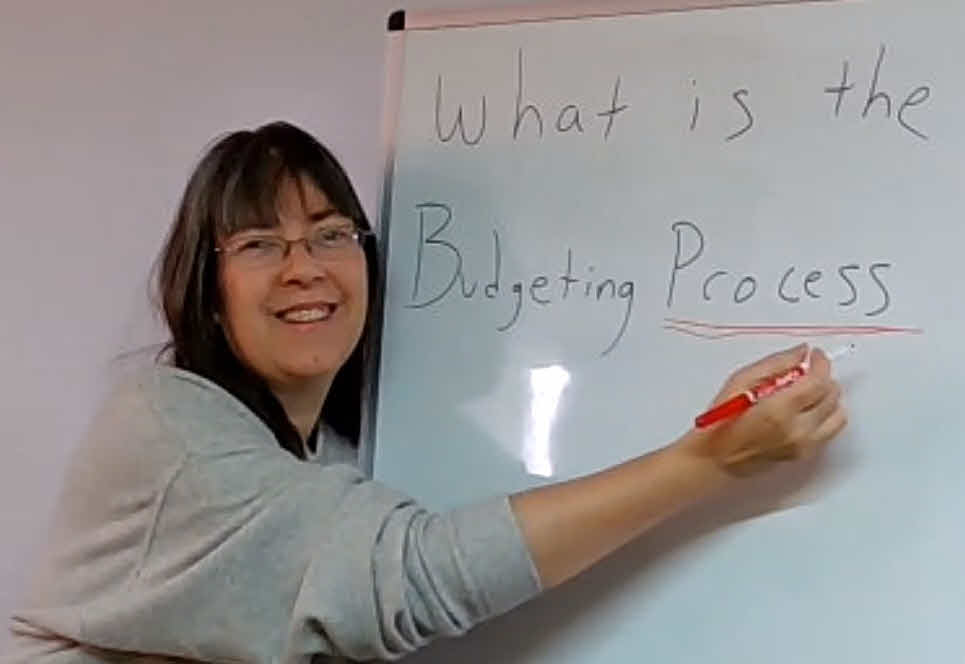

Online Budgeting Tools: Your Digital Finance Assistant

I discovered that online budgeting tools are a game-changer. They’re user-friendly, often free, and provide a clear overview of your finances. By regularly checking my spending and saving habits, I started to see significant improvements in my financial health.

Think of it as having a personal finance coach in your pocket – online budgeting tools help you track, plan, and conquer your financial goals.

Key Features to Look For:

- User-friendly Interface: It should be easy and straightforward to use.

- Real-time Tracking: See where your money is going as it happens.

- Customizable Categories: Tailor it to your unique financial situation.

- Gathering And Analyzing Financial Data

gain insights, and empower yourself to make informed choices that build your dreams - Setting Financial Goals And Objectives

From vague desires to clear targets: translate your financial dreams into actionable objectives. - All About How Childhood Shapes Our Financial Future: More than toys and treats, childhood experiences forge our money mindset. Unravel the hidden threads shaping your financial future.

- Bonus Tips For A Successful Budgeting Process

Every tracked dollar paves the path to your dreams, each expense tamed unlocks doors unseen. Embrace the process, track your journey, and watch your financial compass guide you towards a life filled with choice and adventure. Remember, small steps have a big impact.

Free online tools

- Mint: Mint is a comprehensive budget tracker that allows you to link your cash accounts, credit cards, investments, and bills all in one place. It’s the #1 most downloaded personal finance app and provides insights to help you save money.

- EmPower: Empower offers investment tracking and is a great choice for managing your finances.

- BudgetPulse: BudgetPulse provides varied functionalities, including linking accounts, tracking expenses, and visualizing financial goals.

- Goodbudget: Goodbudget is another free online budget tool that focuses on straightforward budgeting.

- NerdWallet’s Budget Planner Worksheet: NerdWallet offers a monthly budget worksheet based on the popular 50/30/20 rule. It helps you align your spending with this budgeting system.

Automated Savings: The Simple and Effective Technique

The “out of sight, out of mind” approach works wonders. Setting up automated transfers to a savings account ensures that a portion of your income is saved before you even get the chance to spend it.

Why It Works:

- Effortless Saving: Once set up, it takes care of itself.

- Builds Discipline: It instills a habit of saving without the mental burden.

Shopping Smart: Harnessing Discounts and Deals

I learned the art of smart shopping. Look for sales, use coupons, and take advantage of promotions. Online comparison tools are also incredibly helpful in finding the best deals and lowest prices.

Quick Tips:

- Subscribe to Newsletters: Stay informed about exclusive offers and special promotions.

- Use Cashback Apps: Earn rewards for your regular shopping.

- Earn rewards while helping businesses improve! Share your honest feedback and upload receipts to unlock exclusive deals and discounts. Cashback for anything from carrots to hotel stays. Lifelong referral rewards. SWB

DIY Investment Education: Empower Yourself with Knowledge

While avoiding the intricacies of regulated financial terms, I focused on educating myself about general money management. Free online courses, tutorials, and guides proved to be invaluable resources.

Recommended Resources:

- Online Courses: Websites like Coursera or Khan Academy offer free courses on basic financial concepts.

- Books and Blogs: There are countless books and blogs that offer practical advice and innovative strategies.

Networking and Community: Connecting with Like-Minded Individuals

Joining online forums and local groups helped me connect with others on the same journey. Sharing tips, advice, and experiences with peers can be incredibly motivating.

How to Connect:

- Social Media Groups: Platforms like Facebook and LinkedIn have numerous groups focused on money management.

- Local Meetups: Check platforms like Meetup for finance-related gatherings in your area.

The Impact: Transforming Personal Finance into a Path of Success

Implementing these solutions revolutionized my approach to money management. I not only became more efficient and practical with my finances but also felt more empowered and in control.

Success Stories: Real-Life Inspirations

I’ve come across numerous stories of individuals who turned their financial lives around using these strategies. From paying off debt to saving for their dream vacation, the impact is real and profound.

- Debt-Free Journey: Meet Sarah, a young professional drowning in student loan debt and credit card balances. She decided to take control of her finances by creating a budget, cutting unnecessary expenses, and increasing her income. Sarah worked extra hours, negotiated lower interest rates, and paid off her debts systematically. Today, she’s debt-free and shares her journey on social media to inspire others.

- The Frugal Family: David and Lisa were a typical middle-class couple with two kids. They realized that small changes could make a big difference. They started meal planning, shopped with coupons, and avoided impulse purchases. Over time, they built an emergency fund, paid off their mortgage early, and even took a memorable family vacation—all while living within their means.

- The Retirement Dreamer: James, a retiree, dreamed of traveling the world during his golden years. He meticulously tracked his expenses, downsized his home, and invested wisely. James created a diversified portfolio, including low-cost index funds. His disciplined approach allowed him to retire comfortably and explore new destinations, ticking off items from his bucket list.

- The Side Hustler: Maria worked a full-time job but felt unfulfilled. She started a side hustle—selling handmade crafts online. Maria reinvested her profits, learned about marketing, and expanded her business. Within a few years, her side hustle became her primary income source. Maria’s story reminds us that diversifying income streams can lead to financial stability.

- The Early Investor: Michael, fresh out of college, began investing early. He contributed consistently to his retirement accounts, took advantage of employer matching, and educated himself about stocks and bonds. Over time, compound interest worked its magic. By his mid-30s, Michael had a substantial nest egg, allowing him to pursue other passions without financial stress.

Final Thoughts: Your Path to Financial Mastery

Remember, the journey to finding the best money management solution is unique for everyone. What I found effective may differ for you, but the key is to start, explore, and continually learn.

Key Takeaways:

- Start Small: Begin with one strategy and gradually incorporate more.

- Stay Informed: Keep up with the latest trends and updates in money management.

- Be Consistent: Success in money management comes from consistent effort and discipline.

In conclusion, the path to effective money management is paved with knowledge, strategy, and the willingness to explore innovative solutions. By embracing these principles, you too can unlock the door to financial freedom and success.

Remember, it’s not just about finding a solution; it’s about finding your solution. Embrace the journey, and watch as your financial world transforms.

Recommendation: I recommend a free platform to help you save and earn money. They also have a number of resources that can help you learn about personal finance and how to convert and move money online. For example, they have a blog with articles on topics such as budgeting, saving money, and investing. They also offer a free financial literacy course that can teach you the basics of personal finance.

Follow this link: Do you want another Job or More Income, then hit the blue “Contact Me button to get the latest details in your inbox.

Related: